Are you considering ally Bank for your financial needs? In this ally Bank Review, we’ll delve into what makes this bank unique in the digital landscape. Known for its no-frills approach to online banking, ally Bank offers an array of products, including competitive mortgage rates and attractive certificates of deposit (CDs). But what sets ally apart in a market flooded with digital banking options?

Firstly, signing in the ally Bank eliminates the need for physical branches, focusing entirely on an online model. This shift not only brings convenience but also allows for better rates and lower fees. But how does this impact services like mortgages and CDs? ally’s digital platform simplifies these traditionally complex processes, making them more accessible and user-friendly.

However, every coin has two sides. While the absence of physical branches streamlines operations, it might also raise questions about personal interaction and support. Let’s explore further in this ally Bank Review what it has to offer, its advantages, potential drawbacks, and what customers are saying about their experiences. Similarly, Qapital Bank also offers comparable features, which we will examine in detail, especially focusing on the Qapital sign-up bonus of $10 and how it compares to Ally’s offerings.

Pros and Cons: Start the ally Bank Review:

Pros:

- High-Interest Rates: Ally’s High-Yield Savings Accounts and CDs typically offer higher interest rates compared to traditional banks.

- User-Friendly Platform: The online and mobile banking interfaces are intuitive, making it easy for users to manage their accounts.

- 24/7 Customer Service: Despite being an online-bank, like the green dot bank Ally provides round-the-clock customer support.

- No Maintenance Fees: There are no monthly maintenance fees on checking or savings accounts.

Cons:

- No Physical Branches: For those who prefer in-person banking, the lack of physical branches could be a downside.

- Limited Cash Deposit Options: Being an online bank, depositing cash can be a challenge. it is important to find the functionality of cash app that how these mobile payment services let you send and receive money.

- Mortgage Limitations: While Ally offers mortgage services, their options might be more limited compared to specialized mortgage lenders.

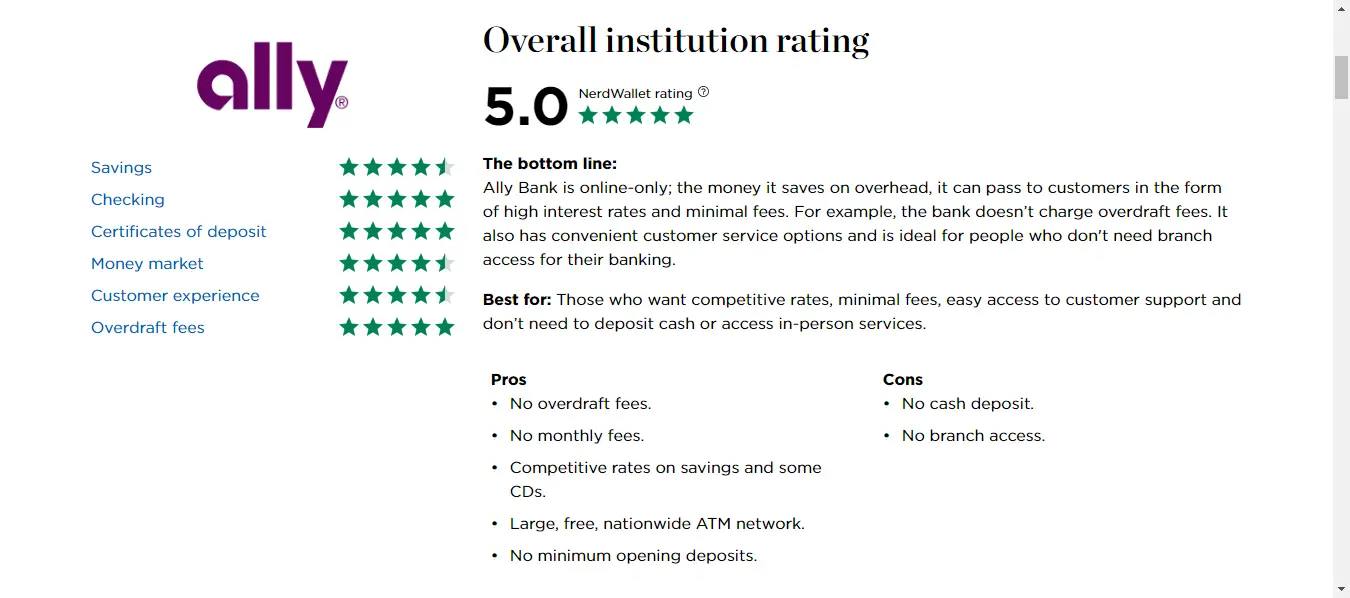

ally Bank Review and rating:

When it comes to public perception, Ally Bank receives positive reviews. Customers often praise the high-yield savings accounts and the convenience of online banking. However, some express concerns over difficulties in depositing cash and the absence of face-to-face interaction. Ratings from financial review sites commonly place Ally high for its savings and CD rates but advise consideration of the lack of branch access.

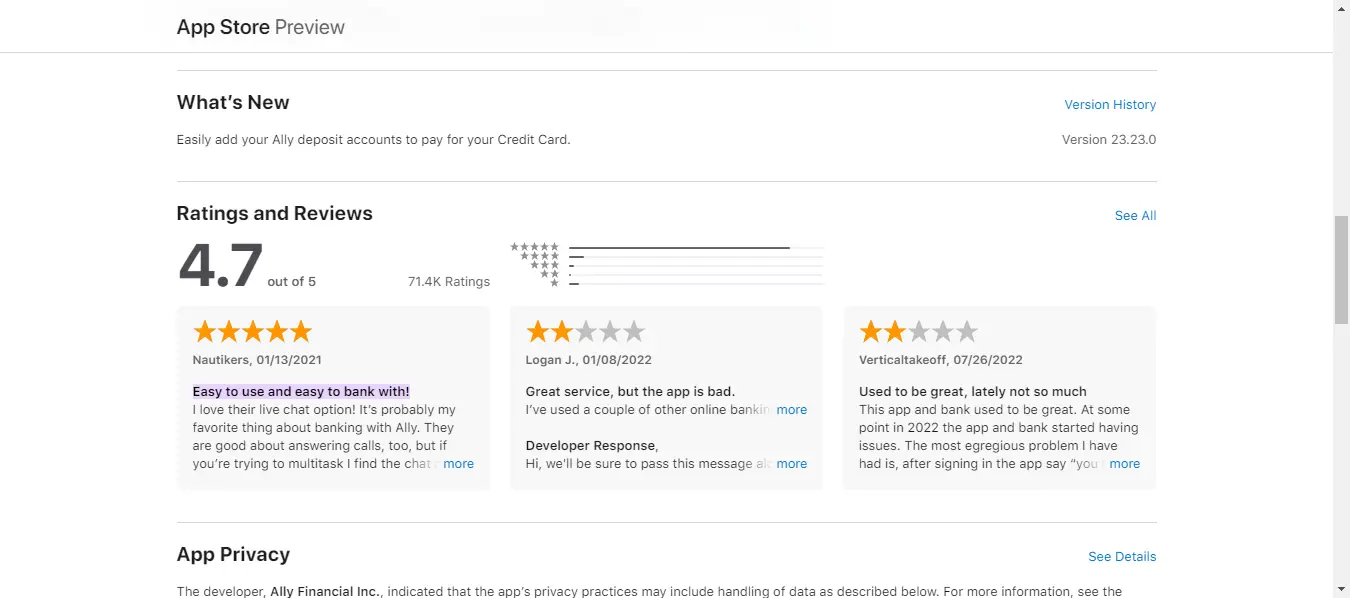

On the Google Play Store, it has a rating of 3.8 out of 5 stars based on over 25,000 reviews , and on the Apple App Store, it has a rating of 4.7 out of 5 stars based on over 71,000 ratings.

Step-by-Step Guide to Signing Up for an ally Bank Account:

Signing up for an account with ally Bank is a straightforward online process. Here are the general steps you would typically follow:

- Visit Ally Bank’s Website: Go to the Ally Bank website.

- Start the Application Process: Click on the ‘Open Account’ button or a similar option and provide personal and business information.

- Verification: ally Bank may require you to verify your identity, which can include answering security questions or submitting documentation.

- Fund Your Account: Decide how you want to fund your new account. This can usually be done by transferring money from another bank account, mailing a check, or setting up direct deposit.

- Review and Submit: Review all the information you’ve entered, read the terms and conditions, and submit your application.

- Confirmation: Wait for confirmation from ally Bank. This may include receiving an email confirmation and additional information on how to use your new account.

Remember, it’s important to have all necessary personal and financial information on hand to ensure a smooth application process. Additionally, if you have any questions or need assistance, ally Bank’s customer service is available to help guide you through the process.

ally Bank Review on Key Offering and Features:

Here is the summary of the key offerings and features of ally Bank in this ally Bank Review article:

- Grow Your Savings Faster:

- Easy access to funds, similar to a savings account.

- Attractive Annual Percentage Yield (APY) rates to grow savings efficiently.

- Money Market Account:

- APY of 4.40% on all balance tiers.

- Maximum FDIC insurance for added security.

- Ally Bank Savings Account:

- Competitive APY of 4.25% on all balance tiers.

- Focus on growing money faster at a great rate.

- Ally Invest:

- Options for Self-Directed Trading.

- Professional insights and stock research tools are available.

- Encourages confident investment decisions.

- Home Loans:

- Streamlined, 100% online mortgage process.

- No hidden fees and competitive rates.

- Comprehensive Financial Services:

- Spending accounts.

- Savings accounts.

- Money Market accounts.

- High Yield CD (Certificate of Deposit).

- Raise Your Rate CD.

- No Penalty CD.

- Investment options include Self-Directed Trading and Robo Portfolios.

- Personal advice for investment decisions.

- Ally Home Services:

- Home purchase and refinancing solutions.

- Ally + Ladder:

- Life insurance options.

Overall, ally Bank offers a wide range of financial products and services, with a focus on online accessibility and competitive rates, catering to both saving and investment needs. you may can find more about on line banking in the article

Conclusion:

To wrap up this ally Bank review, it’s clear that ally offers a compelling digital banking experience, especially for those comfortable with managing their finances online. The high interest rates, user-friendly interface, and comprehensive product offerings make it a strong contender. However, it’s important to weigh the lack of physical branches and some service limitations before deciding. Ultimately, ally Bank represents a modern approach to banking, aligning well with the needs of today’s digital-savvy consumers.

FAQ:

Can I open an ally Bank account if I live outside the United States?

ally Bank primarily serves U.S. residents. To open an account, you generally need a valid U.S. Social Security number and a U.S. mailing address. Non-U.S. residents may face restrictions or might not be eligible to open an account.

How do I deposit cash into my ally Bank account?

Since ally Bank is an online bank, it doesn’t accept cash deposits directly. However, you can deposit cash into a traditional bank account and then transfer it electronically to your Ally account, or use mobile check deposit if you have a check.

Are there any fees for maintaining an account with ally Bank?

ally Bank is known for its no-fee model on many of its accounts, including checking and savings accounts. There are no monthly maintenance fees, but there may be fees for certain transactions or services, so it’s important to review the specific account details.