Ando is a great way to get cash back on the things you buy anyway. You must sign up and use it whenever you buy something in a store or online. After confirming each purchase, you’ll immediately get cash back in the form of Ando Dollars.

If someone you tell about Ando joins, you will get a $15 Ando sign up bonus. Each person you bring in will also get a referral bonus of up to $15. Your referral must open an account with your unique referral link, get a qualifying direct deposit of at least $100, and use their debit card five times within 45 days of opening their account.

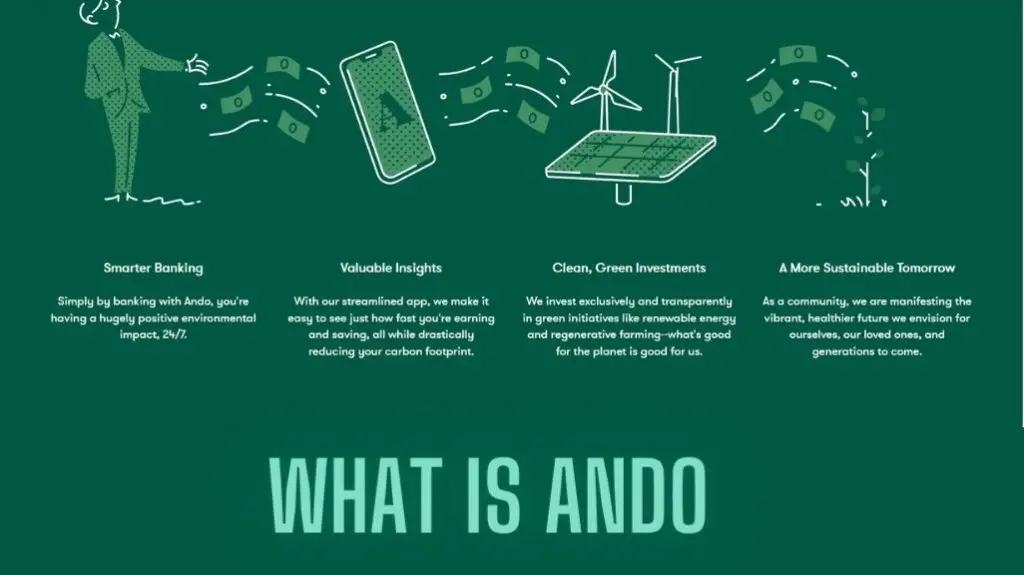

What is Ando?

Ando is a financial app that gives you access to a number of banking services and products. Even though Ando works like a bank, it is not actually a bank. They do work with a real bank, Community Federal Savings Bank, which is why they can offer up to $250,000 in FDIC insurance.

Their whole way of doing business is based on one main idea: sustainability. More specifically, Ando’s goal is to help fight climate change by making banking easy to use and focused on what’s important.

Ando $15 Sign Up Bonus

Ando is a new digital bank that offers a variety of services including checking, savings, credit cards and mortgages. Ando acts as a hub for all your accounts. You can earn up to $15 when you invite a friend to join Ando. You will receive the full bonus once your friend activates their Ando Visa Debit Card, deposits $100, and makes 5 transactions within 45 days.

How to Claim a $15 Ando Sign Up Bonus

Sign up for Ando and you’ll get $15 to spend on whatever you want!

- Go to Ando.com

- Click on the “Claim Your Bonus” link in the upper left-hand corner of their homepage

- Enter your email address, which will be verified before they send you any money

Ando $15 Referral Promotion

Ando is offering $15 for every referring friend who signs up to Ando using your unique invitation code. You can also get a $15 bonus when they make their first order on Ando!

How to claim a $15 Referral Bonus?

- Download the Ando app from the App Store or Google Play.

- Open the app and tap on ‘Get Started’ to sign up for a new account.

- Enter your email, password and select your country of residence.

You will now be taken to the dashboard where you can see all upcoming promotions, offers etc.

PROS & CONS

PROS

- Environment-Positive

- High Maximum APY Rate

- No Monthly Service Fees

- Cash Back on Debit Card Purchases

CONS

- Limited Products and Services

- No Wire Transfers

- No Credit Cards

Ando Features

Ando provides you with some of the most popular features available today, all in a single platform. The following is a list of currently available features:

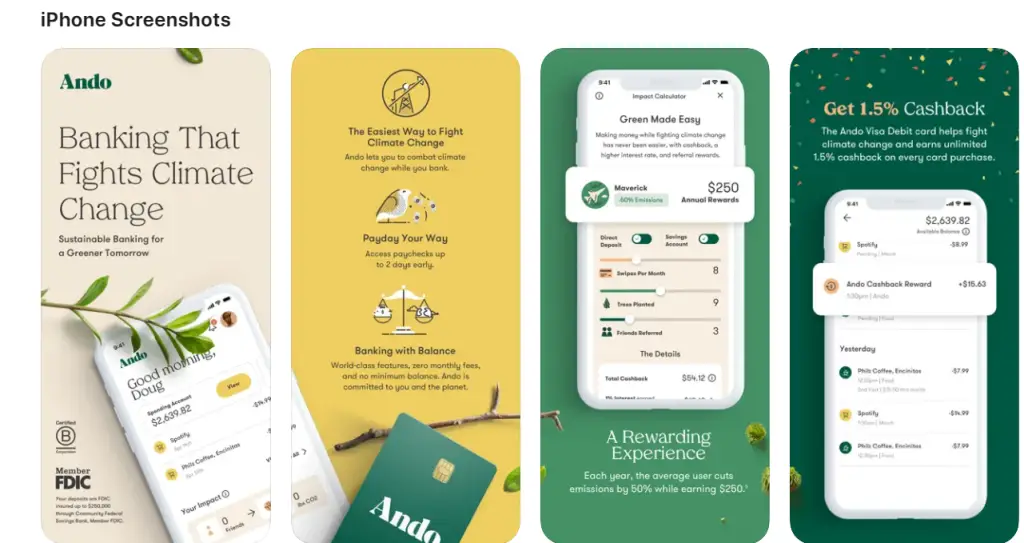

- Unlimited 1.5% Cashback– With Change that Counts, you can earn unlimited 1.5% cashback.

- Fight Climate Change– Deposits are usually invested in fossil fuels by most banks. Ando invests exclusively in green initiatives.

- Increase Your Impact– The more trees you plant, the less CO2 you emit, and the higher your Impact level in Ando’s Impact Center.

- Early Paydays– With Ando’s Early Pay2, you can access your paycheck up to 2 days early.

- Overdraft Protection– Receive up to $200 of free protection from the hassle of overdraft.

How does it work Ando?

The Ando app is simple to use: the first time you open the app, you’ll be prompted to sign up. Once you’ve done that, you need to scan a QR code on any product using your phone’s camera (this could be a piece of art or even an object in nature). The app will then show relevant information about its origins and any relevant information on where it came from and what it means. If there are other people nearby who also have Ando installed, they’ll also have access to this information – so if you see something interesting while out walking but don’t know anything about its background or meaning, just ask around!

How to Earn Ando Cash Back?

You can earn Ando Cash Back in a variety of ways When you open your fee-free Ando Savings Account, you’ll start out earning .17% annual percentage yield. Then, with Grow Your Savings™, you’ll increase your rate to 1.00% APY when you make at least five Ando Visa® Debit Card transactions monthly and enroll in Early Pay™ with a minimum of $500 in direct deposits within a 31-day rolling period. Then keep inviting friends to increase your interest rate up to 5.00% APY.

Is Ando Money legit?

Yes, Ando Money is a legit and trustworthy banking option. While the app is still new to the scene and does not have the advantage of history like other financial institutions, initial reactions are pretty positive overall. With FDIC insurance and Visa Zero Liability protection, your money is safe with Ando.

Ando Fees:

If you withdraw cash from a non-Ando ATM or over the counter, the company charges a fee. This ATM fee will cost you $2.95. However, the ATM operator may also charge you fees, so it’s best to avoid it if you can..

Conclusion

Ando is a great way to earn free gift cards and cash by watching videos, playing games and doing simple tasks. Watching videos or playing games on your phone or computer can earn you money.