This Charles Schwab review can help you make an informed decision if you are still confused about investing your money with them.

Despite all the attractive features, including $0 trade commissions, $0 account minimums, and $0 fees per trade, along with IRAs for those looking to save for retirement, making investments in Charles Schwab requires some assurance.

Our team has thoroughly researched and analyzed Charles Schwab and compiled all the information you need to know in this comprehensive guide.

We have covered the company’s history, reputation, investment offerings, and fees to help you make an informed decision.

If you are a frequent trader, then Charles Schwab’s $0 trade commission policy is one of the biggest advantages for you.

This means that you can buy and sell stocks, ETFs, options, and other securities without paying any fees per trade.

There is much more information in the Charles Schwab review article about why the company boasts over $4 trillion in client assets and serves millions of clients worldwide. However, its transfer fees and limited cryptocurrency assets make it less desirable.

So, without wasting time, let’s dive into the article.

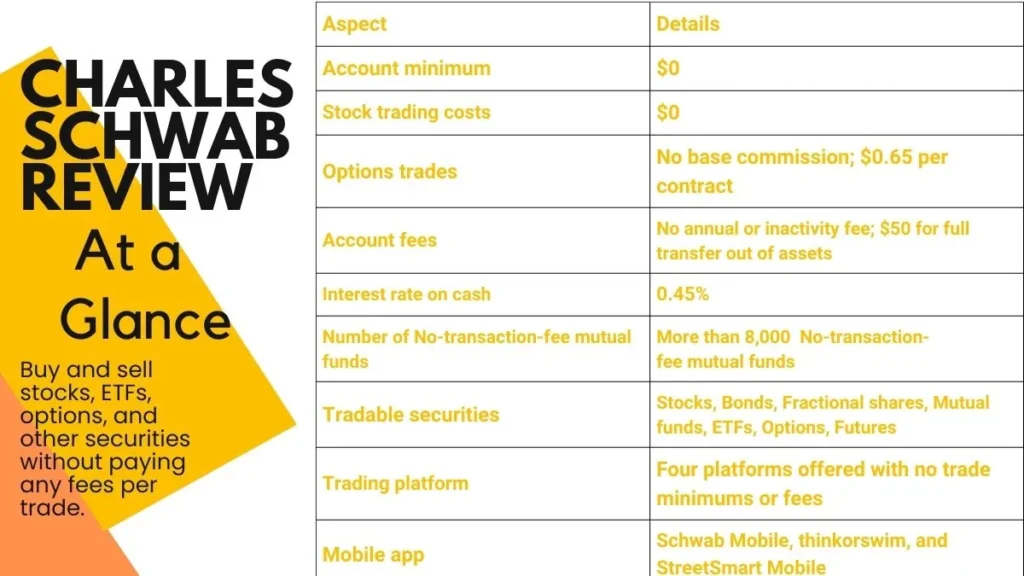

Charles Schwab Review: At a Glance

| Aspect | Details |

| Account minimum | $0 |

| Stock trading costs | $0 |

| Options trade | There is no annual or inactivity fee; $50 for full transfer out of assets |

| Account fees | No annual or inactivity fee; $50 for full transfer out of assets |

| The interest rate on cash | 0.45% |

| Number of No-transaction-fee mutual funds | More than 8,000 No-transaction-fee mutual funds |

| Tradable securities | Stocks, Bonds, Fractional shares, Mutual funds, ETFs, Options, Futures |

| Trading platform | Four platforms offered with no trade minimums or fees |

| Mobile app | Schwab Mobile, thinkorswim, and StreetSmart Mobile |

| Research and data | Research from Morningstar, Argus, S&P, plus in-house commentary and tools |

| Customer support | Phone, email, chat 24/7; in-person support at branches, Monday to Friday 8 a.m. to 5 p.m. |

Pros & Cons

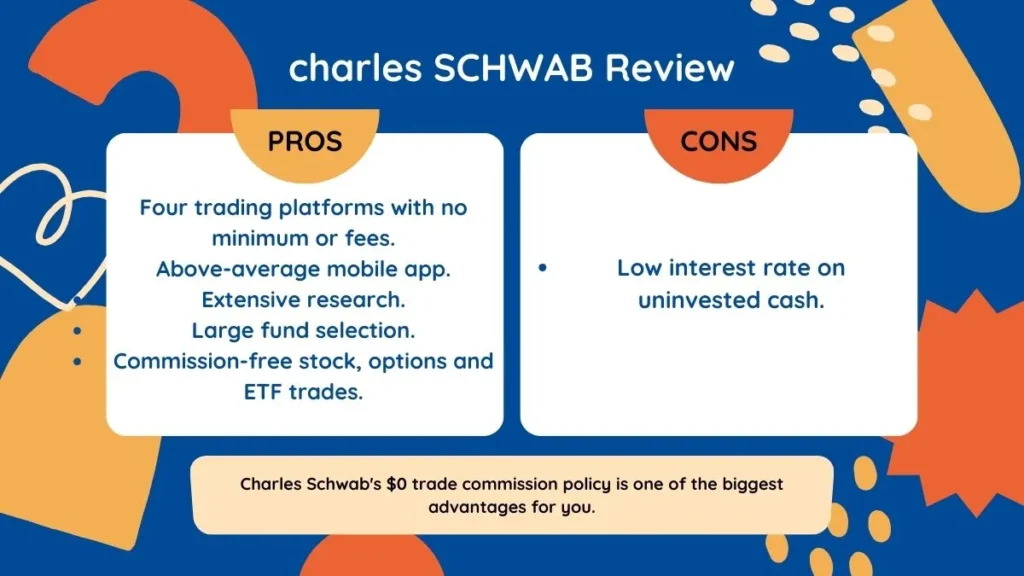

Pros

- Four trading platforms with no minimum or fees.

- Above-average mobile app.

- Extensive research.

- Large fund selection.

- Commission-free stock, options, and ETF trades.

Cons

- The low interest rate on uninvested cash.

Customer Rating About Charles Schwab

- Account Minimum: ⭐⭐⭐⭐⭐ No minimum requirement.

- Stock Trading Costs: ⭐⭐⭐⭐⭐ No commissions for most trades. $0.65 per contract for options trades.

- Account Fees: ⭐⭐⭐⭐½ Low fees with no annual/inactivity fees. $50 for a full transfer.

- Interest Rate on Cash: ⭐⭐ Pays about 0.45% interest rate on uninvested cash.

- No-Transaction-Fee Funds: ⭐⭐⭐⭐⭐ Access to 8,000 no-fee mutual funds.

- Tradable Securities: ⭐⭐⭐⭐ Various investment options available.

- Fractional Shares: ⭐⭐⭐⭐ Option to buy fractions of shares.

- Crypto Availability: NA Not available for direct trading.

- Trading Platform: ⭐⭐⭐⭐ Offers robust trading platforms.

- Mobile App: ⭐⭐⭐⭐ User-friendly mobile apps.

- Research and Data: ⭐⭐⭐⭐⭐ Comprehensive research tools.

- Customer Support Options: ⭐⭐⭐⭐½ Extensive customer support channels.

What Makes Charle Schwab Apart from Others

Trading fees and account types

- There are no fees for stock and ETF trades; $0.65 per options contract.

- Competitive commissions with valuable features like research and customer support are important in Charles Schwab review.

- There is no minimum account requirement, making it easy to begin investing.

- Various account types are available: Individual, joint, IRAs, education savings accounts, 529 education accounts, business accounts (like SEP IRA and solo 401(k)), trust, and charitable accounts.

- Schwab can meet your changing financial needs with its wide range of account options.

No-Commission Funds at Schwab

- Schwab offers around 7,700 mutual funds without a sales load, which is a fee you’d rather avoid.

- Among these, approximately 4,300 funds have no load and no transaction fee, meaning you can buy and sell them without paying any commission.

- This wide selection of funds without fees makes Schwab a great choice for mutual fund investors who want to save money and have plenty of options.

- Schwab’s no-commission funds highlight its investor-friendly approach in the Charles Schwab review, providing more choices without extra costs.

Fractional Shares at Schwab

- A feature called Stock Slices lets you invest all your money, even if you can’t afford full shares.

- Buy a portion of any stock in the S&P 500 index for as little as $5.

- Can purchase up to 30 slices at a time, allowing flexibility in investment.

- The easy-to-use interface simplifies the process, unlike some competitors’ platforms.

- No-commission structure applies to stock trades, saving you money.

- Limited to S&P 500 stocks, unlike competitors offering thousands of options.

- Hopefully, Schwab will expand the program to include more than just S&P 500 companies in the future.

- Additionally, at Schwab, you can reinvest dividends in partial shares, further enhancing your investment options described here in Charles Schwab review.

Research and Tools at Schwab

- Clients receive earnings news from Reuters, Briefing.com, and other reputable sources.

- Schwab provides market commentary from Morningstar, Argus, and CFRA to help investors stay informed.

- For evaluating stock performance, Schwab offers in-house analytical work, including Schwab Equity Ratings. Third-party reports are also available.

- Investors can access Morningstar ratings for each mutual fund to make informed decisions.

- Schwab offers an ETF screener and ETF Select List to help traders efficiently navigate ETF offerings and find top picks.

- The screener also helps investors find socially responsible investment options.

- Schwab BondSource allows fixed-income traders to explore tens of thousands of offerings with ratings from Standard & Poor’s and Moody’s.

High-Quality Trading Platforms at Schwab

- Schwab.com Web Trader

- Entry-level platform offering basic features.

- Monitors major indexes and watchlists.

- Provides access to company financials, trading data, and options chains.

- All-in-one trade ticket for simple and complex trades from one interface.

- Schwab Thinkorswim

- Acquired from TD Ameritrade, it offers a highly customizable trading experience.

- Available on desktop, mobile, and web.

- Advanced charting with hundreds of technical indicators.

- Allows exploration of various trading strategies.

- Live financial news updates keep traders informed.

Schwab Mobile App

- Keeps your accounts safe with strong security.

- It allows you to buy and sell stocks, even complicated ones.

- Shows you the latest news and stock prices.

- Lets you see how stocks are doing with charts.

- You can also watch CNBC live.

- It makes it easy to deposit checks into your accounts.

- Works with Apple Watch for convenience.

- You can also use your voice to do things like trade stocks, check your accounts, and set reminders. All these mobile app services are explained here in the Charles Schwab review.

Customer Support

- Schwab’s customer support is open 24/7, even on weekends and holidays.

- You can reach them via phone, online chat, or email anytime you need help.

- With around 400 Schwab branches and additional TD Ameritrade locations, you can get face-to-face help if needed.

- Webull, Robinhood, and Interactive Brokers, which are online-only brokers, can’t offer this service.

Charles Schwab IRAs

- Schwab offers various types of retirement accounts, including traditional and Roth IRAs.

- They also provide options for self-employed individuals with retirement accounts tailored to their needs.

- IRAs are special savings accounts designed for retirement, offering tax benefits such as tax deductions on contributions or tax-free growth of investments.

- You can have an IRA alongside a regular brokerage account to save for retirement while also investing in other assets.

Charles Schwab review explains all of these things that make it so prominent.

Where Charles Schwab Needs Improvement

Transfer-Out Fees

- Partial transfers are now free, down from $25 previously.

- A full transfer of your account will incur a $50 fee.

- While Schwab generally avoids charging various fees, transfer fees still apply.

- Fidelity, a main competitor, doesn’t charge these fees, suggesting Schwab could reconsider their approach.

Investment Options

- Schwab offers various investment choices like stocks, ETFs, bonds, mutual funds, and futures.

- Some customers may find these options sufficient for their needs.

- However, you’ll need to look elsewhere if you’re interested in forex or direct cryptocurrency trading.

- Schwab’s integration of TD Ameritrade, which offers forex, means these options will be available on the thinkorswim platform starting in 2024.

Is Charles Schwab Right for You?

Charles Schwab suits various investors, offering $0 trading commissions, advanced platforms, and a wide array of inexpensive mutual funds and index funds with low minimum requirements. It offers services to both beginners and experienced investors. Moreover, Schwab provides robo-advisor and financial advisor services through Schwab Intelligent Portfolios for those seeking investment management.

Our review process provides independent assessments to aid decision-making. We collect data from providers and conduct firsthand testing and observation. Combining this with interviews, Charles Schwab review, and research, we evaluate brokers and assign star ratings based on performance.

How it Compares

- Fidelity and TD Ameritrade: Compared to other brokers like Fidelity and TD Ameritrade, Charles Schwab offers competitive $0 trading commissions and a wide range of investment options.

- E*TRADE: While E*TRADE may have lower fees for certain transactions, Schwab’s comprehensive services, including robo-advisor and financial advisor options, make it a strong contender.

- Robinhood: Robinhood may appeal to those looking for simplicity and a mobile-first approach, but Schwab’s robust platforms and research tools provide added value for investors seeking more in-depth resources.

- Interactive Brokers: It may offer advanced trading features, but Schwab’s user-friendly platforms make it a more accessible choice for beginners and experienced investors.

- Tastytrade: Tastytrade is known for its options trading expertise and educational resources.

- Webull: With the Webull sign-up bonus, it features commission-free trading, advanced charting tools, and a user-friendly mobile app.

- Moomoo: Moomoo also offers competitive advantages such as $0 trading commissions, diverse investment options, and user-friendly platforms.

Conclusion

Overall, Charles Schwab review are positive for its $0 trading commissions, diverse investment options, and user-friendly platforms.

Whether you’re a beginner or an experienced investor, Schwab offers something for everyone. With its robo-advisor and financial advisor services, it’s a comprehensive choice for managing investments.

FAQ

Is Charles Schwab suitable for beginners?

Yes, Charles Schwab offers user-friendly platforms and a wide range of educational resources, making it suitable for beginners who are new to investing.

Does Charles Schwab charge commissions for trading?

No, Charles Schwab does not charge commissions for most trades, including stocks, ETFs, and options, making it cost-effective for investors.

How does Charles Schwab compare to other brokers like Tastytrade and Webull?

When compared to other brokers such as Tastytrade and Webull, Charles Schwab stands out for its $0 trading commissions, diverse investment options, and comprehensive range of services, making it a competitive choice for investors.