As someone curious about Kalshi, you might have several questions about this platform. Kalshi, a unique financial exchange, has garnered attention for offering something different in the trading world. As a potential investor, do you want to know about what Kalshi offers and whether it suits your trading needs?

What is Kalshi? Kalshi is a regulated financial exchange that allows trading on a variety of events, ranging from economic indicators like GDP to Supreme Court decisions. It offers both traditional assets like S&P and Forex, as well as unique event contracts. The platform is regulated by the U.S. Commodity Futures Trading Commission (CFTC), ensuring compliance with financial standards.

Kalshi caters to a broad spectrum of traders, making it an ideal choice for both retail and institutional investors based in the United States. Its versatile offerings, including event contracts and traditional assets, suit traders of various expertise levels. This review aims to provide a thorough understanding of Kalshi, covering its services, pros, cons, and overall user experience.

Pros and Cons of Using Kalshi: Begining of Kalshi Review:

Pros of Using Kalshi

- Regulated Trading Platform: Kalshi is the only regulated option for trading event contracts, adding a layer of security and legitimacy to your trading activities.

- Risk Hedging: It offers a unique way to hedge financial risks associated with various events like climate change, geopolitical situations, or health crises like COVID-19.

- Low Entry Barrier: With contracts ranging from $0.01 to $0.99, Kalshi is accessible for beginners, allowing you to start with small investments.

- Controlled Risk: Kalshi doesn’t allow margin or leverage trading, capping your potential loss to the total cost of your purchased contracts.

- Liquidity and Strategy: You can sell your stakes in contracts at any point for profit or hold them until the event occurs, providing flexibility in your trading strategy.

Cons of Kalshi:

- Funding Delay: Funds deposited into a Kalshi account may not be instantly available for trading, which could delay your trading activities slightly.

- Position Limits: Some markets impose position limits of $25,000, limiting trading capacity.

- Limited Stock and Bond Options: Kalshi doesn’t offer pure stocks and bonds trading.

- Liquidity Constraints: Smaller markets may have liquidity limitations, affecting execution speed.

Steps for Signing Up in Kalshi:

Signing up for an account with Kalshi is a straightforward process. Here are the steps to get started:

- Visit the Kalshi Website or Download the App:

- Start by visiting Kalshi’s official website or downloading their mobile app from the App Store or Google Play Store.

- Create an Account:

- Choose the option to create a new account. You’ll need to provide some basic personal business information and create a password.

- Complete the Registration:

- Finish the registration process and wait for confirmation from Kalshi that your account is set up and ready to use.

- Start Trading:

- Once your account is active, you can begin exploring and trading on the platform.

- Remember to start with a comfortable investment size, especially if you’re new to this type of trading, and always be aware of the risks involved in financial trading.

Customer’s Kalshi Reviews and Feedback:

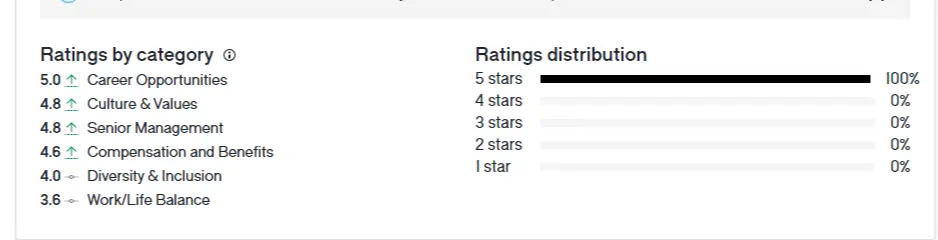

As of March 2022, Kalshi has limited reviews on major platforms like Trustpilot. However, its app ratings are promising, with 3.9/5 stars on the Google Play Store and 4.8/5 stars on the Apple App Store. This suggests a generally positive user experience for those who have engaged with the platform. Customer support is robust, with real-time chat and swift email responses.

Top Kalshi Features:

- Event Contracts: Trade on unique events such as Inflation, GDP, Debt Ceiling, and Supreme Court cases

- Short Duration Trading: Access short-duration options, including 0DTE contracts

- API Integration: Advanced traders can harness the power of APIs for tailored solutions

- Mobile App: Enjoy on-the-go trading with the user-friendly mobile app for Android and iOS

- Real-time Support: Kalshi offers real-time support chat and quick email responses during market hours

- Extended Trading Hours: Ability to trade outside of traditional market hours.

Pricing and Fees:

Kalshi earns revenue through trading fees, which are variable and depend on the expected earnings from each contract. These fees are applied only on the taker side of the trade.

Legitimacy and Launch:

Founded in 2018 and officially launched in June 2021, Kalshi is a legitimate trading platform regulated by the Commodity Futures Trading Commission (CFTC). It has received significant funding, indicating strong market confidence in its business model.

Who is Kalshi For?

With a low minimum initial deposit requirement of just $1, Kalshi is especially welcoming to newcomers to the trading world. The platform’s user-friendly mobile app and robust customer support make it accessible and supportive for all types of users. However, traders should be aware of certain limitations like position limits in specific markets and the absence of traditional stock and bond options.

Conclusion:

In summary, Kalshi stands out as a versatile online financial exchange that offers innovative trading opportunities. While there are some limitations in terms of position caps and asset options, its transparent fee structure and regulatory compliance make it a secure and appealing choice for traders looking for new trading avenues.

Whether Kalshi is the right platform for you depends on your trading preferences and goals. If you’re intrigued by the idea of trading event outcomes and are comfortable with the platform’s limitations, Kalshi could be a valuable addition to your trading strategy.

FAQ:

Does Kalshi offer a free demo account for new traders to practice their strategies?

Yes, Kalshi provides a free demo account, allowing traders to practice without risking real capital.

What are the key advantages of using Kalshi’s API integration for trading?

Kalshi’s API integration allows for customized trading solutions, making it a preferred choice for advanced traders seeking flexibility.

Is Kalshi regulated?

Yes, Kalshi operates under the regulatory oversight of the U.S. Commodity Futures Trading Commission (CFTC).

What can I trade on Kalshi?

Kalshi offers trading on a range of events and traditional assets like S&P, NASDAQ, Forex, and commodities.