If you sign up for a free Lili account using a referral link and meet specific requirements, Lili will give you a $100 bonus. You can earn a $100 Lili welcome referral bonus by opening an accessible Lili business checking account using a referral link.(Lili Bank Sign-Up Bonus)

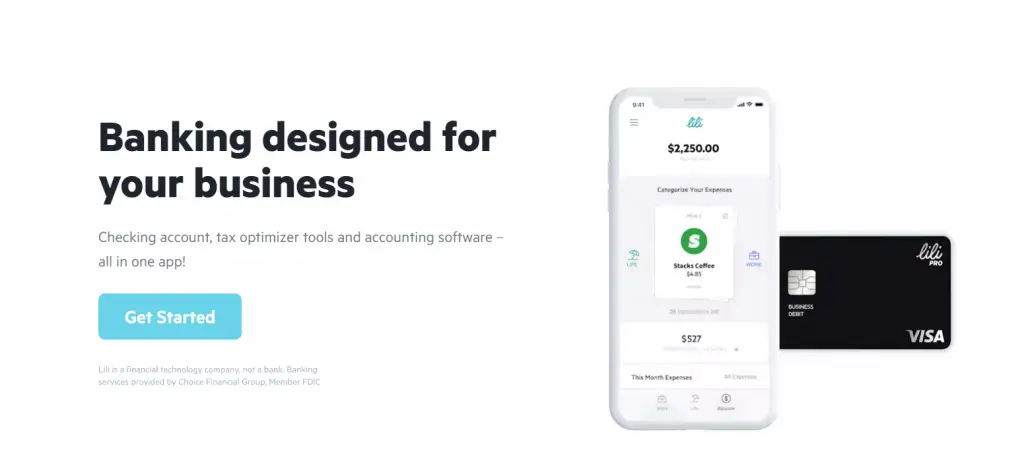

Finance for freelancers and contractors has been revolutionized by Lili banking. Expense management has never been easier with their mobile tax-planning tools!

Lili can be used as a bank account by freelancers and independent contractors. You can categorize your business expenses to save for taxes and accept payments from customers simultaneously – there are no monthly fees, and apps are available on iOS and Android devices.

Get a chance to win $100 by referring a friend to Lili Banking! When you sign up, you will give one lucky Lili account holder a Visa Debit Card. You’ll also get 100 bonus bucks if they spend at least 250 dollars within 45 days after signing up through this referral link or entering “Chandu” during registration.

What is Lili Bank ?

With Lili Bank, you can earn interest on your money and use cryptocurrencies to pay for goods and services. Lili is a fully decentralized blockchain platform:

- No one can access or freeze your funds.

- Transactions are anonymous by default.

- No middlemen are involved.

$100 Lili Bank Sign-Up Bonus

Lili Bank offers a $100 sign-up bonus to new customers who open an account with the bank. When you open an account, you’ll receive your first $50 in cash and the second $50 in a Lili payment card that can use anywhere MasterCard is accepted. You must be at least 18 years old, have a valid Social Security number and US address, and provide two forms of identification before signing up for the offer.

Learn how to make $100 free sign up bonus to make more money.

How to Claim a $100 Sign-Up Bonus

To claim your $100 sign-up bonus, simply follow these steps:

- Download the Lili app on the App Store or Google Play

- Create an account using Facebook or an email address

- Enter a valid credit card number and click “Confirm.”

- Click “Get Started!”

Lili Bank $100 Referral Promotion.

Now, you can earn a referral bonus of $100 for each of your referrals who becomes a new Lili Bank depositor. The more people you refer to Lili Bank, the more money you can make!

How to claim a $100 Referral Bonus?

- You must be an existing Lili customer and have an active account with us.

- Your referral should sign up through your unique link on this page or through our app.

- When they complete their registration process and make the first deposit, you will get a $100 bonus immediately credited into your account!

Lili Bank Review and what they offer

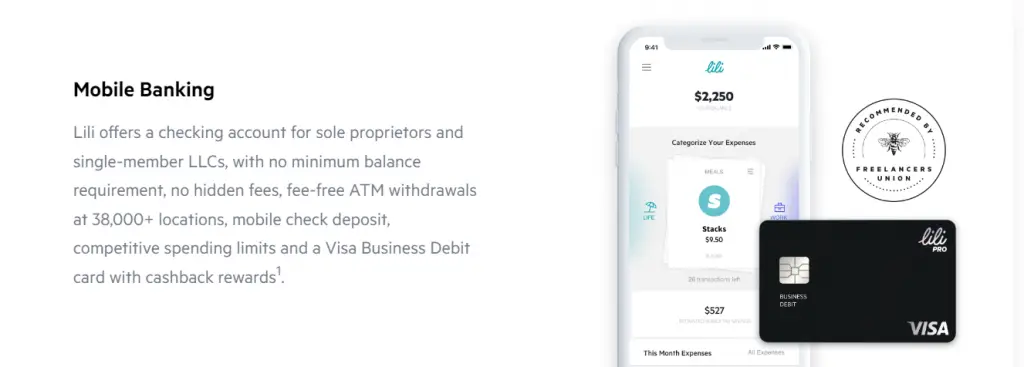

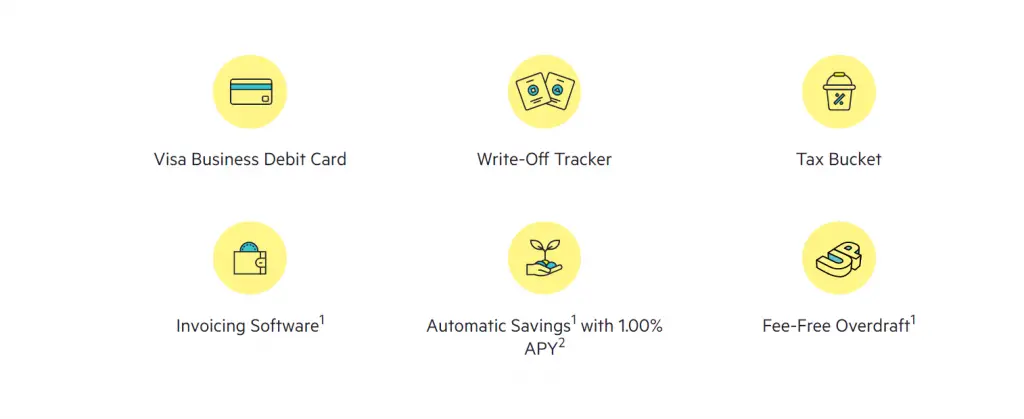

Lili offers an entirely mobile business account with no monthly fees or minimum opening deposits and a host of digital tools for managing expenses, tracking tax write-offs, saving for taxes, and accepting payments from customers.

They offer various accounts, including checking, savings, and credit cards. The types of accounts vary by country, as well as language. In the US, there are currently three types: Checking (in English only), Savings (in English only), and Credit Cards (in both English and Spanish).

About Lili Bank

Lili is an innovative banking platform for freelancers. Not only does it provide helpful tax tools and savings goals, but it also provides information on how much money to save and what accounts are most suitable for achieving these goals!

The Lili bank account is an excellent option for freelancers and more established businesses. To ensure this service works well, use your Social Security number rather than your employer identification number.

Deposits and payments

Lili is highly secure, with measures in place to protect your money. You can use the service confidently, knowing that your personal information and data are safe from malicious attacks, fraudsters, and cyber criminals.

Freelancer BENEFITS

As a Lili freelancer, you can expect to receive the following benefits:

- Free insurance coverage for health, dental, and vision.

- Retirement savings with company matching contributions at 5%.

- Vacation, holiday, and sick days are paid.

How does it work

Lili is a site with a lot of kinks to work out, but it also has the potential to be really cool. The sign-up bonus doesn’t work as advertised, and I’m not sure what you get for your $10 (nothing), but if you want to build an online presence or start your own business without spending money on courses, this could be the place for you.

Lili Bank Features

You can open a Lili account for free – there are no monthly fees and no minimum balance requirements.

- Manage Your Money Better with Data-Driven Insights. ATM withdrawals are fee-free nationwide (other banks or ATM owners may charge a fee).

- There will be cashback rewards for customers who use the Lili Visa Debit Card.

- Simple Expense Category System.

- Establish a tax season fund that is automatically set aside.

- Choice Bank, Member FDIC, is the partner insuring them for $250,000.

Conclusion

There are many reasons to use Lili Bank. It has various features that allow you to take advantage of online financial opportunities, from payment services and transfers to banking products and credit cards. You can access these features in many different ways, including mobile apps for Android and iOS, desktop applications for Windows or macOS computers, and web browsers like Chrome or Safari, which run on any device