Nowadays, sending mobile payments to friends and family is a common way for people to split bills, and the same goes for sending mobile payments to others you cannot afford. Cash, bank trips, and writing checks are no longer necessary with money apps such as Paypal/Venmo promotion.

Paypal/Venmo(Paypal/Venmo promotion) apps make it easy to split meal costs with friends. In the United States, both are popular. Which is the best? You can find out by reading this post, as we will compare these two most commonly used money transfer apps. Let’s begin by discussing each option briefly.

Paypal?

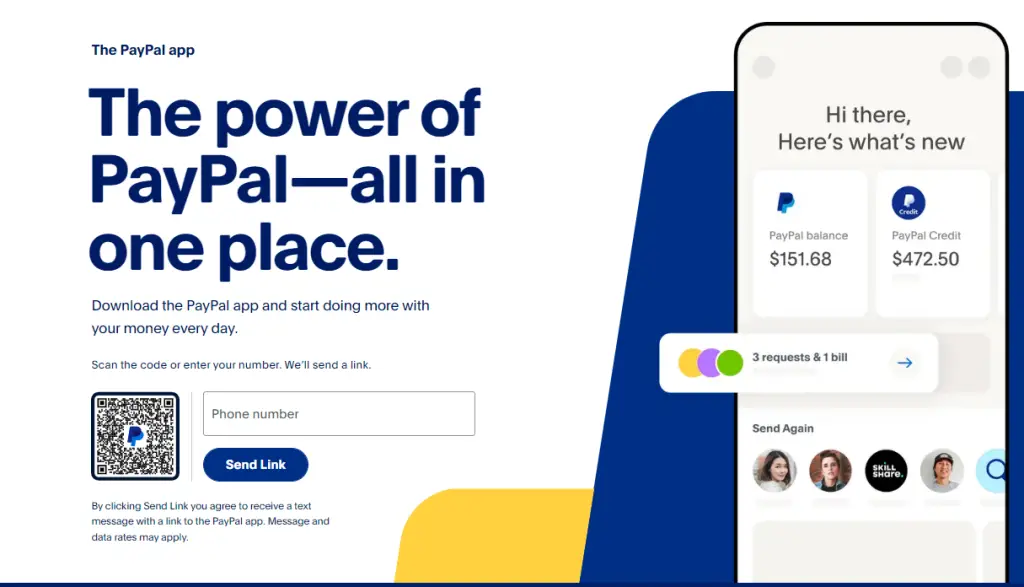

With PayPal, you can now buy, sell, send, receive, and explore in one place. Get paid back for last night’s takeout, send money to friends with PayPal accounts, buy and checkout with crypto, manage your bills, and more with PayPal. Additionally, we’ve added some new features we think you’ll love.

Do you love PayPal? Earn rewards by referring a friend. Both of you will receive $10 once they sign up and make a purchase over $5. You can earn up to $100 if you keep referring.

Venmo?

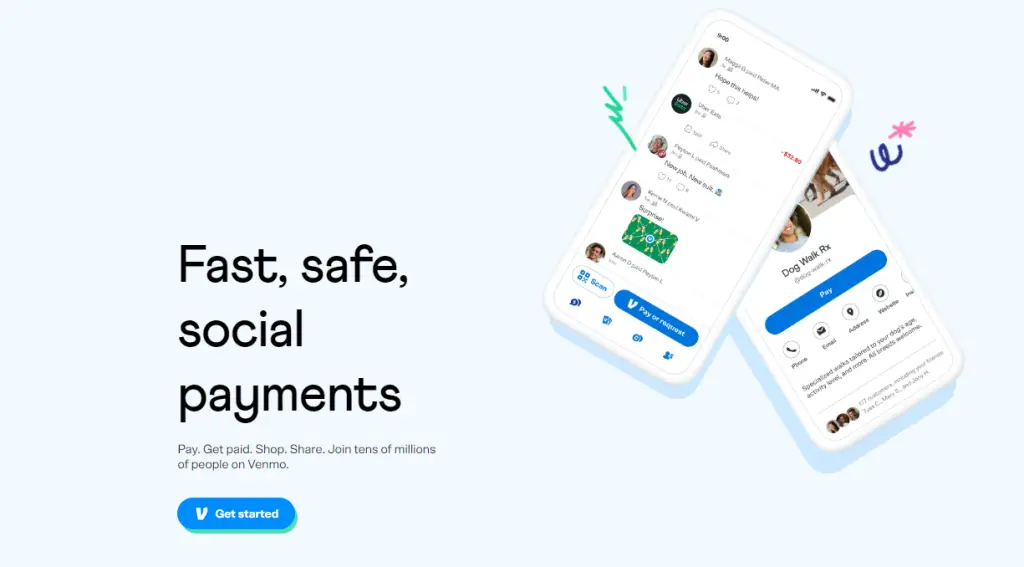

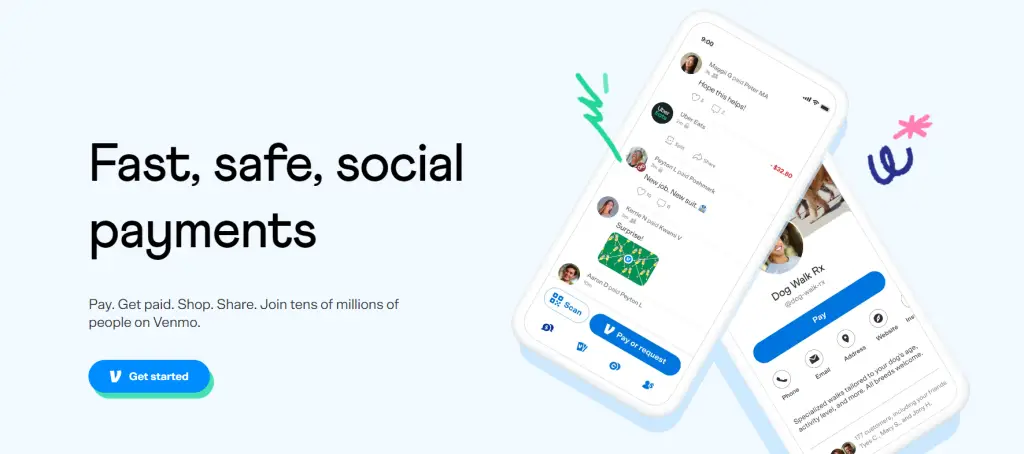

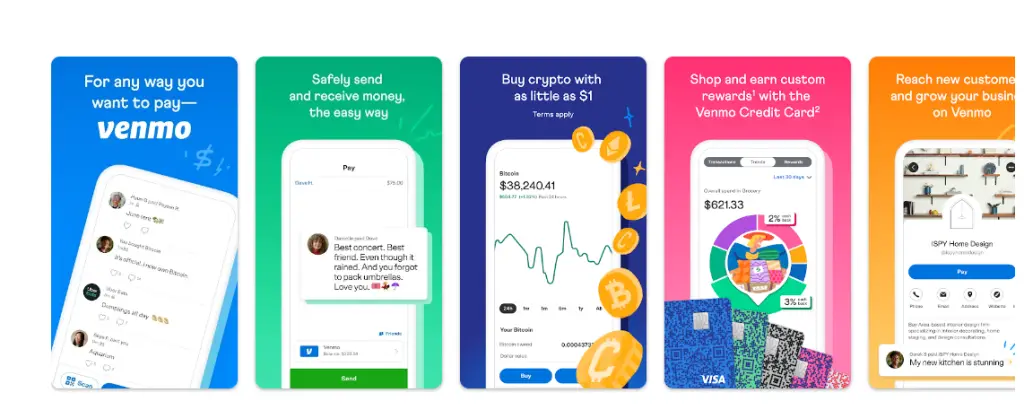

When you don’t want to deal with cash, Venmo provides a convenient way to send money to friends and family. Using the Venmos mobile app, users (account holders) can quickly and easily transfer money between Venmo accounts. Know What Venmo Sign Up Bonus and Referral Bonus

Paypal/Venmo Comparison:

Now have discussed their features, let’s compare the two thoroughly and let’s see which has most of the perks!

What is the Fastest App?

Venmo:

With Venmo, you can transfer money instantly, but it takes a 1% fee. A regular money transaction through Venmo takes 1-3 business days.

Paypal

One of the world’s largest online payment processors is PayPal. Sign Up Now! Secure all your Transactions with our 24×7 Fraud Prevention. Sign Up Now! 180-days Buyer Protection. B2B Payments. Buyer Protection. Faster Checkout. Website Payments. No Top Up Needed.

Which app is user-friendly?

Venmo:

The Venmo app allows for easy navigation and is fun to use. Users connected to the service can be viewed by scrolling through the list when a user selects them.

Venmo users can see who is paying through a social media streaming device. While sending and receiving money, you can also include GIFs, emojis, and messages.

There is no difficulty finding contact information. Enter the recipient’s name to send an email or make a payment. Alternatively, you can provide your phone number, email address, or Venmo username

Paypal

Which app is cheap?

Venmo:

Venmo charges a 1% fee in case of instant transactions. When paying from a credit card, it can deduct up to 3% of the transferred fee.

Paypal

Which is the more reliable option?

Both Paypal/Venmo is considered reliable and the safest options up to date.

Paypal/Venmo PROS CONS

Is It Legit?

Venmo Features

Lets discuss its important features.

1. Convenient and quick payment options: Withdrawing money from venom to the bank account takes up to three business days. Venmo charges a 1% fee for instant transfers, which can speed up the process. In that way, money transfers will be super fast.

2. Reliable & Free: Venmo has no regular fees, such as those charged monthly or annually. Transferring money from your Venmo balance, debit card, or bank account is reliable and free. You won’t be charged any fees for receiving money or transferring it to your bank account if you choose an instant transfer instead of a standard transfer.

3. Freely Switch-in between Credit or Debit Card Options: A Venmo payment card is available for frequent Venmo users. Cardholders can choose between a debit and a credit card. With Venmo Debit Cards, users can access their Venmo balance. Some stores offer cash-back offers through it, and there is no annual fee.

4. Payable at select merchants: In addition to Uber, GrubHub, Hulu, Poshmark, and Foot Locker, Venmo is a checkout option on many other applications and websites. Venmo can streamline the checkout process at businesses that accept Venmo.

5. Enhances the social aspect of payments: Venmo stands out as a different kind of payment app. Likes, comments, and messages are attached to each payment in this payment app, similar to social networks. Despite its inconvenience to some users, it is a rather enjoyable feature for others.

Now let’s see what Zelle has to offer.

Paypal Features

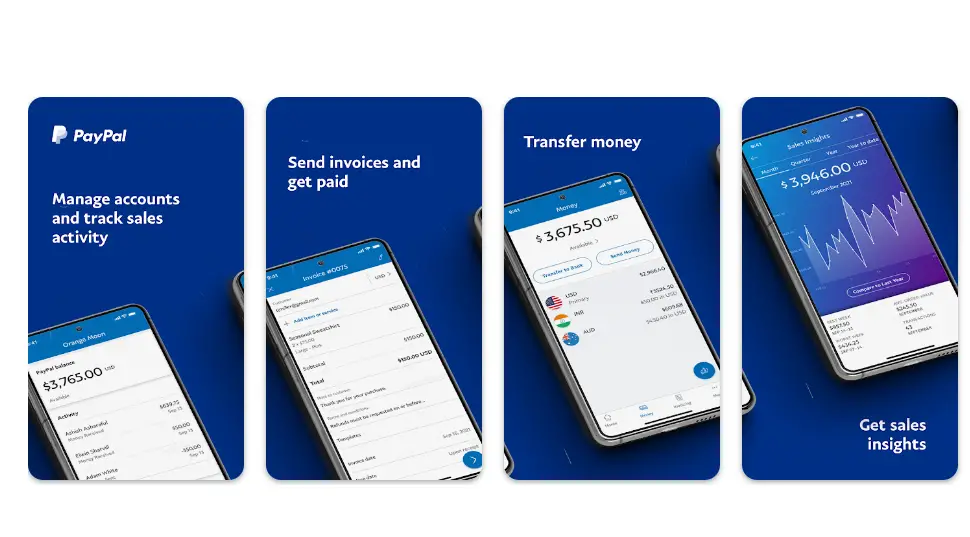

- Easy-to-use invoice maker lets you create and send invoices quickly

- Keep track of your money and sales

- Keep track of your online account activity

- Money transfer

- Overview of monthly, quarterly, and yearly sales trends

- Quickly access customer information

- SEND INVOICES AND GET PAID

The PayPal Business app makes it easy to create, send, and manage invoices for your business. Small business owners and merchants can also use PayPal’s invoice maker to send payment reminders directly to customers from their mobile devices, saving them time. You’ll get paid faster and with fewer headaches.

- MANAGE SALES AND ACCOUNT ACTIVITY

At a glance, you can see your business’ daily sales, monthly sales, quarterly sales, and yearly sales. You no longer have to guess how your sales are doing! Your business can make smarter money management decisions with updated sales trend information.

- TRANSFER MONEY

With a few taps, you can move money to your linked bank account, issue refunds, and send money. This mobile money management app saves you time and frustration by skipping the bank lines. This flexibility makes small business owners and merchants feel like they have a finance manager at their fingertips.

- ACCESS CUSTOMER INFORMATION

Use the PayPal Business app to view customer transactions, including invoicing and processing histories. From your mobile device, you can also check customer contact information and contact them directly. You can also import your contacts easily!

Small business owners and merchants can easily make and send invoices, get paid, and manage their money with the PayPal Business app. A small business app that fits your lifestyle!

PayPal vs. Venmo: Safety and Security

The security features offered by PayPal and Venmo keep your information safe. Each transaction is protected with encryption, two-factor authentication of your account, and 24/7 customer support. No matter what platform you choose, you can feel confident about the security of your data.

FAQ

How Do Venmo and PayPal Work?

The basic functionality and setup of both services are the same. You create a free account with the service, establishing your security credentials. You then link at least one bank account for transfers and optionally add other payment methods, like additional bank accounts or debit and credit cards.

What Are Venmo and PayPal?

Having been established in the late 1990s, PayPal quickly became the payment tool that facilitated millions of eBay transactions. On the other hand, Venmo is a relatively new player.Venmo, on the other hand, is a relatively new player. After being founded in 2009, Venmo was acquired by Braintree in 2012 and then by PayPal in 2013.

What exactly is crypto?

Crypto, short for cryptocurrency, is a form of currency that only exists in the digital space. Many believe that crypto could one day be as commonly used as cash and credit.