The Self Visa Credit Card is different from typical secured credit cards because it doesn’t require a separate cash deposit to secure the card. Instead, it uses the balance you’ve accumulated in a credit builder loan with Self as collateral for the credit card. This means that you can access a portion of your saved money while also improving your credit history by using the card responsibly. The credit card is directly tied to the progress you’ve made in building your credit through Self’s credit builder loans, making it a useful tool to establish or improve your credit history.

What is a secured card?

A secured credit card is a type of credit card that requires a deposit to be made as collateral. This deposit is typically the same amount as the credit limit offered on the card. Secured cards are designed to help individuals with poor or nonexistent credit histories to build or rebuild their credit lines.

Now that you are aware of secured cards and the difference between a self-secured credit card and other secured cards let’s dive into learning more about self-secured cards. In this review article, all your questions about the Self card will be answered. Our top priority is your safety, and we want to ensure that you are protected from fraud and scams.

Pros And Cons of the Self Visa Card:

Everything comes with its pros and cons, but what matters most is whether the advantages outweigh the drawbacks. When it comes to your safety and priorities, it’s crucial to consider them first. That’s why we highlight both the benefits and potential downsides of the Self Visa card. Here is a summary of the Self Visa Credit Card, specifying its inherent advantages and potential drawbacks:

We want you to make an informed decision based on your financial situation and the rules and guidelines that Self follows. That way, you can feel confident about choosing what’s right for you.

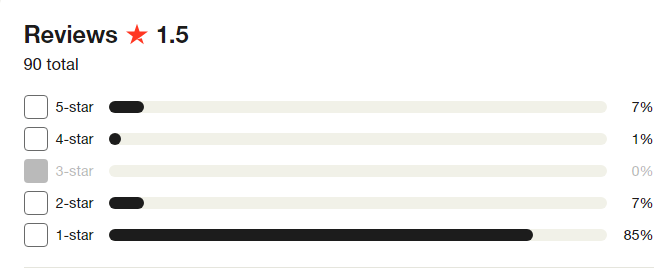

Self Visa Credit Card Review Rating: According to Trustpilot:

The reviews for the Self credit card are mixed. Some people who have had a good experience with Self are praising it, while others who have had a bad experience are saying negative things about it. Trustpilot has given the Self Visa card a review rating based on customer feedback.

.

Public Reviews About Self Visa Credit Card:

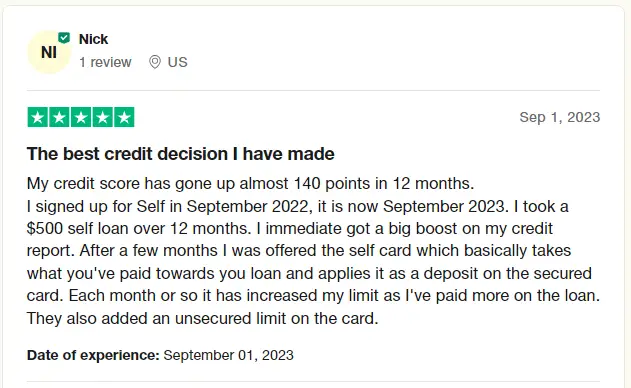

If you’re currently using the company’s credit builder loans and are not satisfied with the traditional secured card, we have got you covered. In this review article, you will find all the answers to your questions about the card. Our top priority is your safety, and we want to ensure that you are protected from fraud and scams. Nick, after experiencing Self-Card, is so satisfied with it. Look how he praises Self Visa Card.

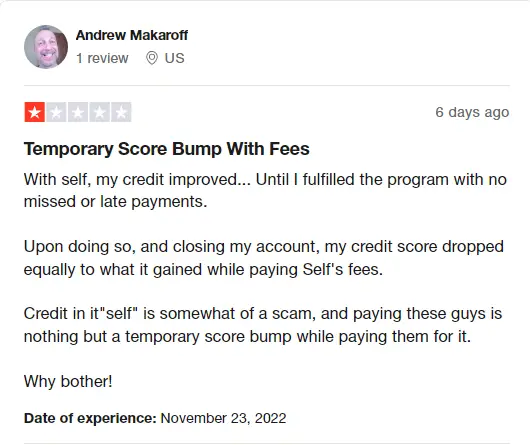

After experiencing a late fee penalty, Andrew was harsh on himself and shared his experience with us. Experience speaks louder than words, so take a look.

How does the Self credit builder card work?

Here’s how you can qualify:

- Pay a one-time, non-refundable $9 administrative fee.

- Repay the account through fixed monthly installments over the loan term. This payment history is reported to the three major credit bureaus (Experian, Equifax, and TransUnion).

- This process aims to help build credit by leveraging a credit-builder account and, once qualifications are met, transitioning to a secured credit card with a saved deposit as collateral.

Benefits and Perks:

The benefits and perks of the Self Visa Secured Credit Card are as follows.

- No Hard Inquiry on Your Credit:

- The qualification process doesn’t involve a hard inquiry, which avoids a temporary lowering of your credit score.

- No Traditional Deposit:

- Unlike many secured cards requiring a cash deposit, the Self card secures your credit using a CD, an interest-bearing account, rather than keeping your money idle with the issuer.

- Automatic Qualification:

- Simple qualification criteria: After making three on-time payments totaling at least $100 to your credit builder account, you become automatically eligible for the Self Visa Secured Credit Card. Ordering the card is the next step after qualification.

Rates and Fees:

Interest Rates

- Regular APR: 29.24% variable APR

- Purchase Intro APR: N/A

- Balance Transfer Intro APR: N/A

Fees

- Annual Fee: $25

- Balance Transfer Fee: N/A

- Cash Advance: N/A

- Foreign Purchase Transaction Fee: None

Conclusion:

In conclusion, the Self Visa Credit Card presents an appealing option for those seeking to establish or rebuild their credit history. Its unique structure allows for building credit without a hard check and enables people to secure a credit card using the funds saved in their Self Credit Builder Account.

However, it comes with a few drawbacks, such as a $25 annual fee, a high variable APR, and the absence of a rewards program. It also requires a more complicated setup with a Credit Builder Account as compared to traditional secured credit cards.

Overall, the Self Visa Credit Card’s potential benefits in credit building can outweigh its limitations, especially for target users who have poor or no credit. As always, potential users should carefully consider their individual financial needs, circumstances, and the card terms prior to application.

FAQ:

Does the Self Visa Credit Card require a credit check?

No, the Self Visa Credit Card doesn’t require a hard credit check. You can apply for this card using your savings progress from an open Credit Builder Account.

Will there be an initial deposit for this card, like other secured credit cards?

Unlike regular secured credit cards, the Self Visa Credit Card doesn’t require a traditional deposit. The security deposit is made from your existing Credit Builder Account

Does the Self Visa Credit Card offer any rewards or cashback?

No, the Self Visa Credit Card does not offer any rewards program or cashback.