Nowadays, sending mobile payments to friends and family is a common way for people to split bills, and the same goes for sending mobile payments to others you cannot afford. Cash, bank trips, and writing checks are no longer necessary with money apps such as Venmo vs Paypal.

The Venmo vs Paypal apps make it easy to split meal costs or travel costs with a friend. Both have their fair share of popularity among people in the United States. But which is the best? To find out, keep reading this post as we will draw a fair comparison between these two most frequently used apps for money transfers. Starting with let’s discuss each option briefly.

Venmo refer-a-friend program offers a $20 referral bonus when you invite someone to join via Venmo referral code and they open a personal Venmo account. Invited users will also receive a $10 Venmo sign-up bonus.

If you don’t currently use PayPal, finding friends may be difficult. With this offer, you can both earn a $10 bonus.

- You can earn up to $100 by referring 10 friends to PayPal

- Donate 1 cent to a friend who doesn’t have PayPal

- Sign them up and ask them to link their bank account or debit/credit card

- When they spend or send $5+, you’ll both get $10.

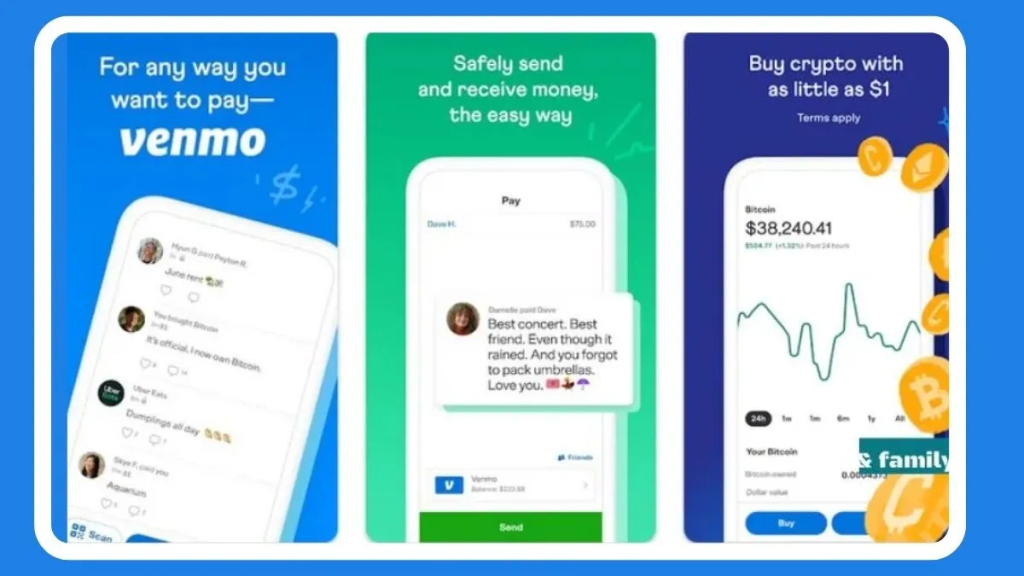

Venmo

Venmo is an app that provides a convenient solution to send money to friends and family when you don’t want to deal with cash. Using Venmo’s mobile app, users (account holders) can also transfer funds quickly and easily among Venmo accounts

Paypal

PayPal is a secure and easy way to pay for products, as well as receive payment. PayPal lets you make online purchases at participating stores using your bank account, credit card, or debit card. PayPal is a third party that facilitates transactions between buyers and sellers.

See the referral program page here.

Venmo Features:

Let’s discuss its important features.

- Convenient and quick payment options: Withdrawing money from venom to the bank account takes up to three business days. Venmo charges a 1% fee for instant transfers, which can speed up the process. In that way, money transfers will be super fast.

- Reliable & Free: Venmo has no regular fees, such as those charged monthly or annually. Transferring money from your Venmo balance, debit card, or bank account is reliable and free. You won’t be charged any fees for receiving money or transferring it to your bank account if you choose an instant transfer instead of a standard transfer.

- Freely Switch-in between Credit or Debit Card Options: A Venmo payment card is available for frequent Venmo users. Cardholders can choose between a debit and a credit card. With Venmo Debit Cards, users can access their Venmo balance. Some stores offer cash-back offers through it, and there is no annual fee.

- Payable at select merchants: In addition to Uber, GrubHub, Hulu, Poshmark, and Foot Locker, Venmo is a checkout option on many other applications and websites. Venmo can streamline the checkout process at businesses that accept Venmo.

- Enhances the social aspect of payments: Venmo stands out as a different kind of payment app. Likes, comments, and messages are attached to each payment in this payment app, similar to social networks. Despite its inconvenience to some users, it is a rather enjoyable feature for others.

Now let’s see what Paypalhas to offer.

Paypal Features

- SEND MONEY SECURELY– Every payment you make is protected by 24/7 transaction monitoring, secure encryption technology, and fraud protection.

- SEND MONEY AROUND THE WORLD– You can send money around the world with PayPal’s mobile app.

- MANAGE YOUR MONEY EASILY– Your PayPal account makes it easier for you to track and monitor every PayPal transaction you make.

- LEGAL- Account required to send and receive money. Money can be accessed by the recipient even if they do not have a PayPal account.

Venmo VS Paypal Comparison:

When it comes to choosing an app for your mobile payment needs, Venmo vs Paypal are two of the most popular options.

But which is better? Which one will work best for you? Here’s a look at what each app has to offer and how they compare.

Which is the faster app?

Both Venmo vs Paypal are fast, but Venmo wins out in this category because you can send money to anyone in your contact list who also uses Venmo. PayPal is limited to sending money only to people who have an email address or phone number associated with their account, so if someone doesn’t have one of those things linked up, they’ll need to create an account first before they can receive funds from you. This takes some time, so don’t expect something as instantaneous as Venmo alerts!

Which app is more user-friendly?

Venmo is more user-friendly because it gives you more options for sending and receiving money, as well as making purchases online through their official website or app store. Paypal does not offer these features yet, but they might be working on them soon!

Venmo is more user-friendly because it gives you more options for sending and receiving money, as well as making purchases online through their official website or app store. Paypal does not offer these features yet, but

Which app is cheap?

Which is the more reliable option?

How to create a Venmo account

- To qualify for the $10 bonus, you must join Venmo through this referral link.

- Add your bank account, debit, or credit card to verify your new Venmo account.

- Send at least $5 to anyone using the Venmo App within 14 days of the join; otherwise, you lose $10 bonus.

- Once you send $5, you’ll receive $10 bonus direct to your wallet.

If you wish to join the Venmo app, use this Venmo free money code 2022 “cSOjEXZCwtb” and register your account to claim a $10 sign up bonus. With Venmo you can make money with referral free.

How to create a PayPal account

- Visit PayPal.com or download the PayPal app from the App Store or Google Play.

- Click the button to register.

- Select “Personal Account.”

- To access your account, enter the security code you received by text message on this screen.

- In the Member Information area, enter your first and last name, email address and a secure password.

- Once you’ve entered your mailing address and agreed to PayPal’s privacy policy, the account will be created.

- In addition, set up a credit card or bank account to be used for purchases through PayPal

Venmo vs Paypal fees

Both Venmo and PayPal charge a fee to send money to your friends. For example, if you send $100 to a friend, you’ll pay $3.99 in fees. That’s because Venmo charges a flat fee of 3% each time you send money, while PayPal charges 2.9% plus $0.30 each time you transfer money. See the Paypal fees page here.