Want a $25 sign-up bonus for Free? Multiple cashback and reward apps give $25 just for signing up and doing some qualifying steps. These apps are Rebatesme, Upromise, Payoneer, Timesclub, MyPoints, BeFrugal, Rakuten, top cashback, and many more.

Here are some of the best ways to make extra cash, all of which could help you earn $25 fast.

There are number of apps that pay a $25+ sign up bonus to open an account and perform some easy task. Some apps also have referral promotions that you can join and invite your friends to earn extra money.

RebatesMe.com– Use this site to earn cash back on orders from Amazon, Best Buy, Target, and other retailers. The minimum payout is only $5.

TimesClub– Get $10 for each friend you refer to TimesClub who purchases an item from a TimesShops online store. You’ll also get $1 for every dollar spent at any of these stores: Best Buy, Dell Home & Business, Lenovo, or Newegg.

Befrugal– You can earn 5% cash back on dining out by using the Befrugal app on your phone or tablet at participating restaurants nationwide once per month. Plus, they have special deals like free shipping if you sign up for their newsletter!

TopCashback– This site offers rebates as high as 20% off items like air travel and hotels through Expedia when you sign in with TopCashback promo codes! The minimum payout is only $10, too, which makes it easy to start saving right away!

Let’s discuss in detail how to qualify $25 sign-up bonus from these apps:

Temu

The Temu online shopping platform offers many exciting products, the latest fashion items, and cosmetics at affordable prices. Temu is the most popular e-commerce site after Amazon, and many people download Temu apps.

Earn a $25 Temu Sign-up bonus when you open a new Temu account using Temu coupon code “com95307”. Plus, you will get $5 for downloading Temu apps and an additional 50% discount on your first purchase.

Sign Up Bonus Step

- Visit this Temu Referral Link Download app, then Sign up.

- Now, Enter your name and email to verify your Temu account.

- To get your Temu bonus, enter the Temu promo code com17893 in the app.

- Done! Your Temu Sign Up Bonus will be deposited, and you can use it on your next purchases or withdraw it.

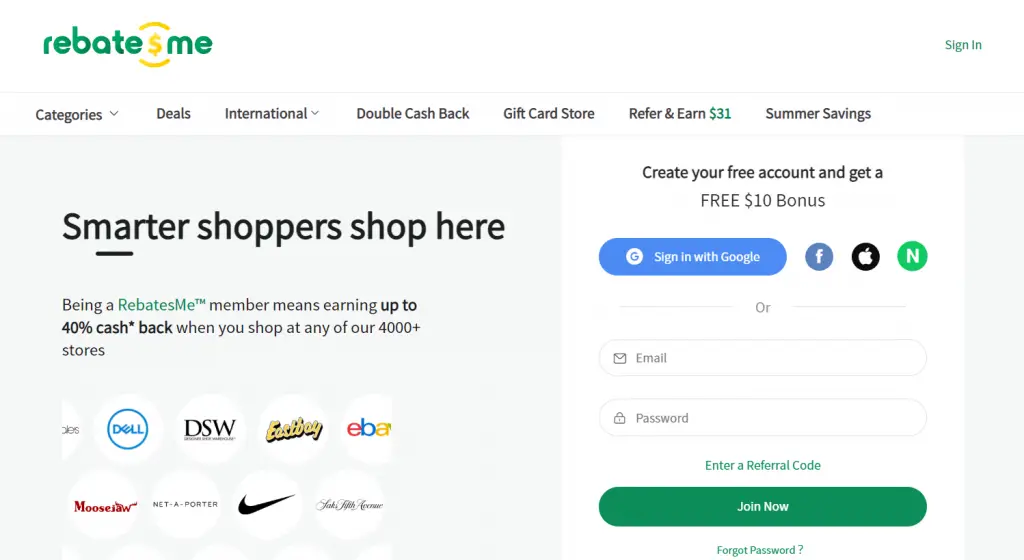

Rebatesme

RebatesMe is a popular cash back website that facilitates users to earn a percentage of their online shopping expenses back as cash.

RebatesMe is affiliated with a wide range of online retailers, including top-rated fashion, electronics, beauty, and home goods stores. This enables users to receive cash back from purchases they would make anyway.

To get started, you need to register with RebatesMe. Using the referral code hnk1v5 will give both of us a $25 sign-up bonus, which is how we can get cash back on our purchases!

Direct Sign-up without a referral link will get you $5. However, using the RebatesMe referral link or promo code: hnk1v5 will get you $30.

You can earn $10 by referring friends to RebatesMe for a limited time. Register for Rebatesme, make a qualifying purchase, and you’ll receive a $25 sign-up bonus. Read the full guide on Rebatesme sign up bonus.

How to claim a $25 sign-up bonus

- Click on the link below to join Rebatesme.

- Visit the site Rebatesme.com, and click the “Join” button in the top right corner.

- The required fields must be filled in (name, email, password, etc.)

- Check your email for a confirmation message from Rebatesme containing your unique referral code hnk1v5.

- Once Rebatesme has successfully verified you as a new member with an active account, log into your account on Rebatesme.com and navigate to. On their website, there will be an option to “See all my offers.” By clicking this link, you will have access to all their available offers!

Timesclub

Timesclub is a cashback site that pays you to shop at your favorite stores. It is free to join, and you can earn cash back on every purchase. The cashback is paid to you through a check, or you can redeem it for gift cards.Sign up for the Times Club using promo code ZECKFE and get $25 (2022)

TopCashback is our topcashback site because it offers 100% commissions back to its members. Rebatesme and Rakuten consistently offer lower cashback rates than TopCashback.

How to sign up for Times Club:

Here’s how to signup for Times Club:

- Download the Times Club app from the App Store or Google Play.

- Use referral code ZECKFE during Sign Up to Get $20.

- Click on the “Times Club Official site.” button. And an extra $5. You will have $25 in your wallet.

- Enter your email address and click “Continue.”

- Enter your name, and phone number, and choose a password.

- Click “Sign up,” and You can Subscribe to Times club by using code “ZECKFE” to get a $20 Signup Bonus and a $5 Bank linking Bonus.

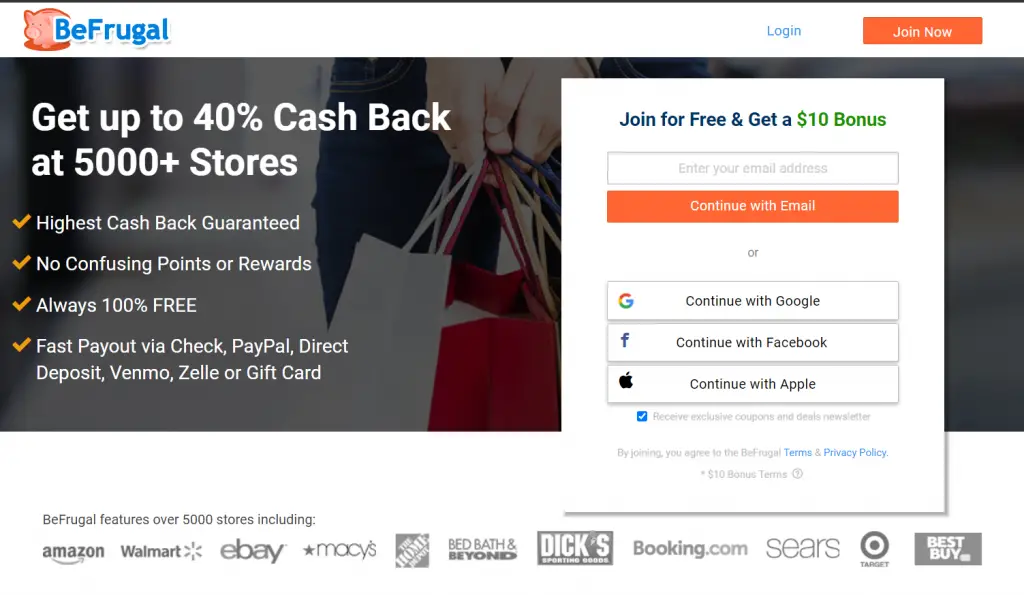

BeFrugal

BeFrugal is an online shopping portal that allows you to earn cash back on your online purchases. BeFrugal is a free-to-join program, but offers a $25 sign-up bonus (which can be paid out via a check or sent directly to your PayPal account).

To qualify for the $25 sign-up bonus, you must make one purchase within 30 days of signing up from any of the retailers listed on their site. Once you meet this requirement, you will receive your $25 gift card reward code by email.

How to claim a $25 BeFrugal Sign-up bonus

- Sign up for BeFrugal.

- Link your card.

- Complete the survey (you can save time by clicking on “previous” and then “next” to advance through each question).

- Get your $25 sign-up bonus!

Topcashback

The TopCashback sign-up bonus is a one-time $25 bonus for simply signing up and making your first purchase. It’s not a bad deal considering you don’t even have to do anything other than browsing the site and making an eligible purchase, but it’s best to find something that will earn you cash back with them (like an Amazon Prime membership).

Their points again! The minimum amount of cashback is $5, which means that after spending $100 on purchases through TopCashback, you would receive your first round of Money in about 13 months—a little slow by most standards but acceptable considering there are no fees or costs associated with the program.

Each year, the maximum amount that can be earned is capped at 200% of the amount spent (up to $75), meaning that if someone spends over their limit, they will have to wait until next year to redeem. Read the full guide on Topcashback sign up bonus

How to claim a $25 Topcashback Sign-up bonus.

- Go to the (https://www.befrugal.com/).

- Join now by clicking the button.

- Enter your email address.

- Enter your name, and then click Next.

- Click Next after entering your date of birth.

- Enter your address, and then click Next.

Rakuten

If you do lots of online shopping, you must have encountered Rakuten. It is a top shopping cash back app which rewards are high as their welcome bonus and other offers.

Rakuten welcome bonus keep changing, and different links offer different rewards. Shop online through Rakuten and earn a $25 sign up bonus.

Rakuten is a cashback portal similar to more popular options like Swagbucks and TopCashback. You can earn a $25 sign up bonus from Rakuten using this Rakuten referral link and then shopping from a retailer of choice.

How to claim a $25 Rakuten Sign-up bonus

- Click the button to go sign up page.

- Enter your name and details to open an account.

- Install Rakuten browser extension on your device.

- Make a total purchase of $30 or more within 90 days of account opening

- You will receive your $20 Rakuten sign up bonus

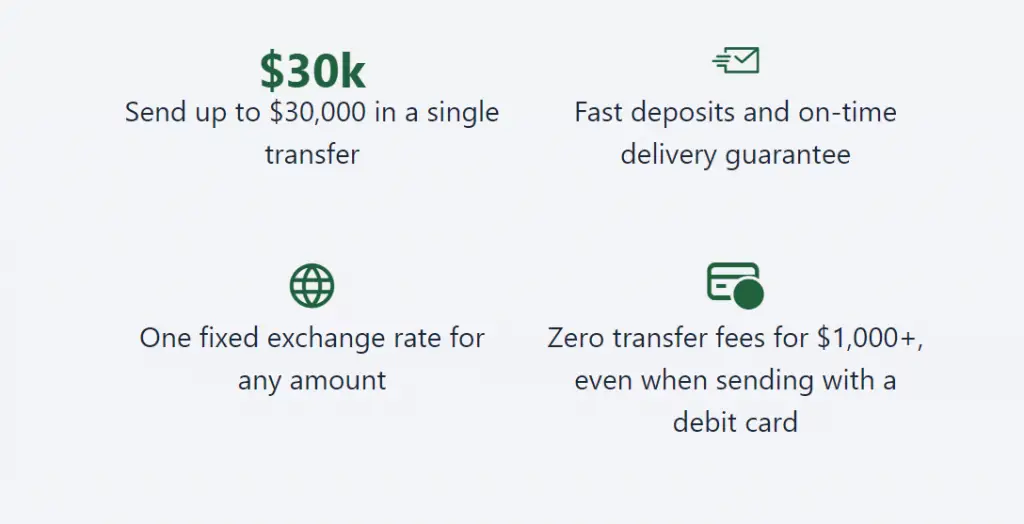

Wise

With Wise, you can earn cashback rewards when you shop at any online retailer as well as some physical stores. The amount of money you receive in your Wise account depends on the retailer, but it can be as much as 15%.

Wise has partnered with over 3000 retailers so far, so you have plenty to choose from! The company has partnered with Amazon, Walmart, Target, and many other popular retailers that offer amazing deals and discounts, so you can save more!

How to claim a $25 Wise Sign-up bonus

You can claim a $25 sign-up bonus if you have an account with Wise. To get your bonus, follow these steps:

- Sign in to your Wise account and go to the “My Account” section of the website.

- Enter your email address and password, then click “Continue.”

- Fill in all other information required to complete registration. This includes: name, phone number, location (in case of issues), birthday and security question answers (in case of issues).

Remitly

Remitly is an online remittance service based in Seattle, United States that offers international money transfers to over 135 countries.

How to claim a $25 Remitly Sign-up bonus.

To claim your $25 sign-up bonus, you’ll need to:

- Download the Remitly app from the App Store (iOS) or Google Play Store (Android).

- Sign up for a new account using your email address and phone number. You can download our app here if you haven’t already! Select “Yes, I’d like to receive rewards points” when prompted during registration.

- Complete the additional registration steps on desktop or mobile and finish claiming your cardless cash transfer within 30 days of completing the sign-up process when prompted.

SoFI

Sofi is a rewards program that offers cash back on your purchases. Saving money without changing how you spend money is a great way to maximize your spending.

If you’re in college or high school, Sofi is an easy choice. The sign-up bonus alone covers most of the cost of one year at most colleges, and can be used toward textbooks or tuition payments when they are due (or paid off early).

How to claim a $25 SoFI Sign-up bonus

- Create a new SoFi Money account if you don’t already have it. Make sure to use a referral link to register.

- Deposit at least $10 in your SoFi Money fund account. This deposit should be made within 5 days of opening your account. You can do it either by linking a bank account or via an instant transfer from your debit card.

- You’ll receive your bonus in less than 2 weeks after completing all the requirements. Usually, it’s faster than that.

Bright Money

Bright Money is an amazing app that helps you to get rid of your credit card debt using AI ( Artificial Intelligence).

You’ll also get $25 credit when you sign up for Bright Money. New members will receive a $10 bonus after making a $10 transaction through the Bright Money app. Get a $25 bonus by using the current member’s referral link.

How to claim a $25 Bright Money Sign-up bonus

- Click on the Above Button, and you will get redirected to the Sign up Page.

- Enter your phone number and verify your details.

- Now In the “Have a Referral Code option,” put Bright Money Referral code “Referrloffer“

- After Signing up, Make a $10 transaction, such as contributing cash to your savings goal.

- After your 10-day free trial has ended, sign up for a Bright Money Premium subscription plan.

- Activate your Bright Money Stash Account today for a $25 credit, which you can use for savings, credit card payments, or withdrawals to your checking account.

Upromise

Upromise is a rewards program for college savings. Upromise works similarly if you’re familiar with the concept of cashback credit cards. Whenever you shop online through their site, you earn points that can be redeemed for tuition, books, and other school expenses.

You can also use Upromise to donate your rewards to one of their pre-selected charities or set up your own account so that Upromise will donate your points back into the account when it reaches a certain amount (this is how I’ve been saving up my Money).

The best part? The sign-up bonus is pretty generous! When you sign up with Upromise as a new user, they’ll deposit a $25 sign-up bonus into your account just for setting up an account with them!

How to claim a $25 Upromise Sign-up bonus

To qualify for the $25 bonus, all you have to do is:

- Open a new Upromise account via this Upromise promotion link:

- Download the Upromise app or register online.

- Enter your basic details and get verified.

- You will be asked for the saving method, and be sure to select “529 College Saving Plan,” which links to your 529 college saving plan.

- Earn an extra $25 bonus to link your 529 college plan with your Upromise account. If you don’t have a 529 plan, you can read the full process of How to apply for a 529 plan with a scholarship.

- Upromise sign up process link 529 account

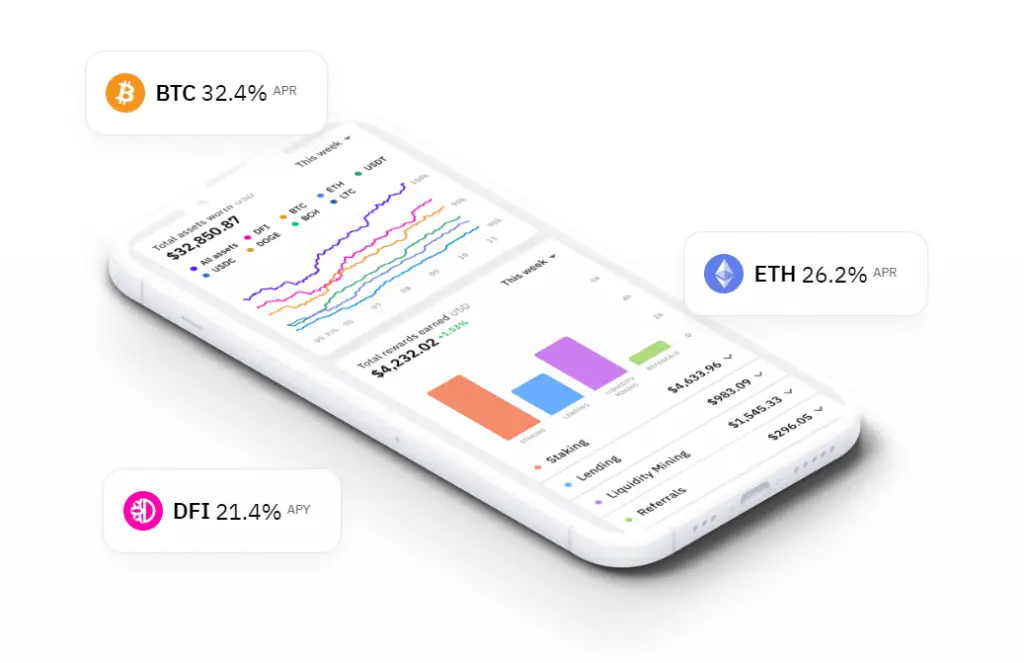

Cake Defi

The cake is a financial management app that helps you track and save Money. You can use Cake to set up savings goals and then make automatic transfers from your bank account into a separate goal to help you reach it. They also have several other ways to earn rewards for saving, such as through their referral program or by paying with the app.

Cake referral program is pretty straightforward: they’ll give you $5 when someone joins using your referral code, and if they spend over $100 within the first three months of joining, they’ll give both of you another $5 each! It’s a great way to get rewarded for helping out your friends with money management tools.

Payoneer

Payoneer is a global payment processor that allows you to send and receive Money online and in-store and make payments from your bank account. They do this by linking your bank account with their own payment network, which then processes payments online or at physical locations.

Payoneer offers a $25 sign-up bonus for new customers, who can earn money just for signing up and referring others through their referral program. Payoneer also has a mobile app that allows users to manage all of their accounts with ease on the go.

How to claim a $25 Payoneer Sign-up bonus

- Click on the ‘Refer a Friend’ button at the top of our website.

- The next page will have a referral code, which is your unique identifier. The code is case-sensitive, so be sure to copy it exactly as it appears in the box.

- Enter your personal details (name, email address, and phone number) into their corresponding fields on this page.

- Click. Your unique link has now been created!

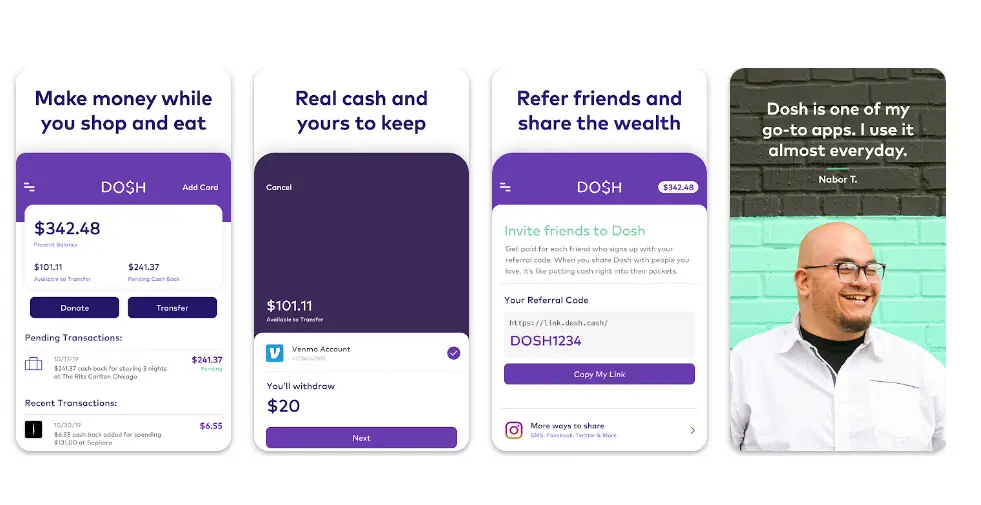

Dosh

Dosh is a cash-back app that automatically applies rebates to your purchases from thousands of famous retailers when you shop online, book hotels, or dine out.

How to claim a $25 Dosh Sign-up bonus

- Download the Dosh app with this link.

- Get an instant $10 sign up bonus when you make your first purchase.

- Connect your card or any payment method that you like.

- Shop on the brands you love and get 10% cashback.

Earn at least $25 through the Dosh app, which can then be transferred to your PayPal or Venmo account.

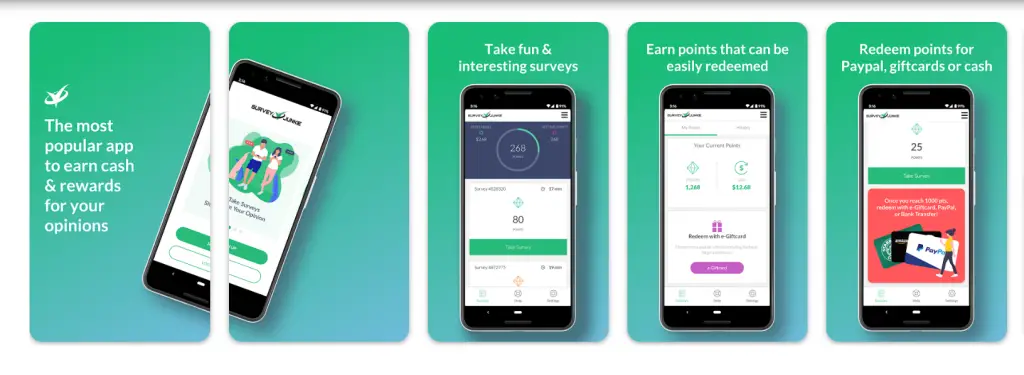

Survey Junkie

Survey Junkie will pay you to complete surveys on different products and services. It doesn’t take much time, and if you get stuck (which happens), there’s a guide available in the app that can help walk through each question with examples, Read the full guide on Survey Junkie sign up bonus.

How to claim a $25 Survey Junkie Sign-up bonus

- Download the Survey Junkie app with this link.

- First name

Last name

Email address

Date of birth

Gender

ZIP code

Country of residence. - Complete their general profile and category-specific profiles after verifying their email address.

Conclusion

If you are new to the $10 sign-up bonus, click on my referral link so I can get credit for helping you get started. We know how much you love earning cash back, so we’re always looking for new ways to make it happen.

FAQ

How do i get $25 Sign Up Bonus?

Sign up for a MyPoints account with a referral link and receive a $25 welcome bonus. You can earn this bonus by entering your name within 30 days and earning $10 cash back.

What apps give you $25 Sign Up Bonus?

Get a $25 sign up bonus to open an account with cashback apps like RebatesMe, Rakuten, MyPoints, and Swagbucks.

How to Get $25 Dollar Instantly?

To get $25 dollar instantly, you can try multiple methods on the internet. Take surveys, watch videos, get paid to talk, and more are some of the best ways you can earn money. Sign up for a Payoneer account, take surveys, watch videos, and get paid to talk.