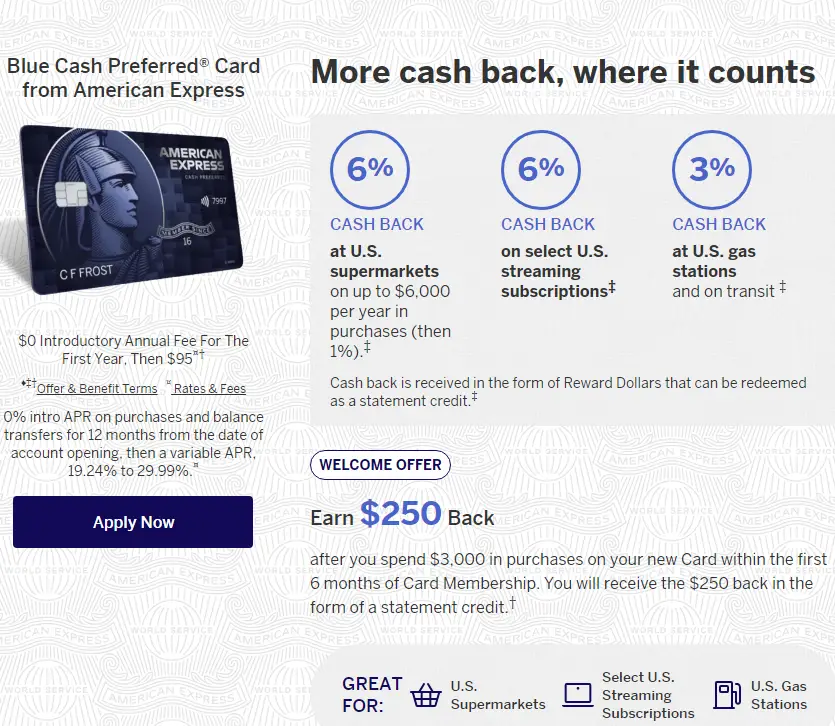

Earn $250 through your AmEx Blue card preferred sign-up bonus cash back after you spend $3,000 on your new card within 6 months of your card membership. This $ 250 signup bonus can be redeemed as a statement credit, cash dollar, or gift card.

The AmEx Blue Card Preferred has numerous other benefits, like 6% cash back on select U.S. streaming subscriptions like Netflix, Hulu, and Spotify. Commuters and travelers alike can take advantage of the 3% cash back on transit purchases such as rideshare services (e.g., Uber, Lyft), public transportation (e.g., buses, trains, subways), parking, tolls, and taxis. Using the AmEx Blue Card Preferred card sign up bonus.

Let’s explore how you can claim an AmEx Blue card preferred signup bonus along with maximizing your savings on everyday expenses like grocery shopping, streaming services, and transit.

AmEx Blue Cash Preferred SignUp Bonus (Get $250):

By opening a new account through the AmEx Blue Card Preferred card signup bonus link and following some qualifying steps, you will get $250. These steps are mentioned below.

How to Avail AmEx Blue Card Preferred card signup bonus?

To avail of the AmEx Blue Card Preferred card signup bonus reward as a new card holder, you must follow the following steps.

- SignUp Bonus Website: Visit the AmEx Blue Card Preferred signup bonus website and search for Referral Link.

- Start the Process: Click on the Referral Link.

- Fill out the Application Form: Provide all requested personal and financial information.

- Read all the terms and conditions. Review all card terms and conditions. Ensure you understand the fees, rates, rewards program, and other details about card usage.

- Submit the Application: After completing the form and agreeing to the terms, you will submit it for review.

- Wait for Approval: American Express will review the application. If you’re instantly approved, you can expect to receive your card in the mail within 7-10 days.

AmEx Blue Cash Preferred other advantages

You can avail the advantages of:

- 0% Annual fee and APR: 0% intro annual fee and 0% intro APR on purchases and balance transfers for 12 months from the date of account opening. This means you don’t need to pay the full amount. Rather, just pay the minimum amount, and you will not get any interest.

- Plan It: Through the AmEx Blue Card Preferred card signup bonus, you can split up large purchases into monthly installments with Plan It.

- Monthly Installments: Up to 10 active payment plans can be created, each subject to a fixed plan fee charged monthly based on factors like purchase amount, account history, and creditworthiness.

- Equinox: Up to $10 in statement credits each month per card through Equinox after enrolling in the AmEx Benefit Dashboard. , totaling $120 per calendar year across all cards on the account.

- Disney Bundle: Through the AmEx Benefit Dashboard, you can earn a $7 statement credit monthly reward after qualifying purchases of $9.99 or more (excluding taxes) at Disneyplus.com, Hulu.com, or Plus.espn.com.

Important Information Regarding Fee, Interest of AmEx Blue Card Preferred card signup bonus:

As a new cardholder, the things you may keep under your consideration are fees and rates on the AmEx Blue Card Preferred card, which are as under,

Fee:

Annual Fee: After 1 year, a $95 annual fee will charged.

- Transaction Fees: The brief description of transaction fees is,

a)Balance Transfer: Either $5 or 3% of the amount of each transfer, whichever is greater.

b)Cash Advance: Either $10 or 5% of the amount of each cash advance.

c)Foreign Transaction: 2.7% of each transaction after conversion to U.S. dollars.

- Penalty Fees:

a)Late Payment: Up to $4

b)Returned Payment: Up to $40

c)Overlimit: None

Annual Purchase Rate(APR):

- APR fee: An APR of 19.24% to 29.99%, based on your creditworthiness and other factors, will be charged after 1 year.

Bottom Line of AmEx Blue Card Preferred: As A New Card Holder

In conclusion, the AmEx Blue Card Preferred offers a fantastic opportunity for new cardholders to maximize their everyday spending fully. The high cashback rates, particularly the 6% on U.S. supermarket purchases and select U.S. streaming subscriptions, along with the 3% on transit purchases, stand out prominently among cashback rewards from other credit cards.

Beyond the attractive cashback rewards structure, the $250 opening account reward further adds to the overall value, provided that new cardholders satisfy the initial spending requirements within the first three months. With these rewards and features clearly tailored for those who often spend on groceries, transit, and entertainment, the AmEx Blue Card Preferred could be an excellent option for many consumers. However, it’s always crucial for potential cardholders to understand the specific terms and conditions.

FAQs:

Which type of purchases qualify towards the $1,000 spend requirement for the $250 welcome bonus?

Eligible purchases for meeting the spending requirement generally include those made directly with American Express or through their partners. Cash advances, balance transfers, purchases of gift cards or traveler’s checks, interests, and fees are typically not considered qualifying purchases.

What is the annual fee for the AmEx Blue Cash Preferred Card?

The AmEx Blue Cash Preferred Card comes with an annual fee of $95. However this may be offset by the high cashback percentages you can earn on everyday purchases, making the card valuable for people with high spending in the bonus categories.

Where can I get 6% cash back with the AmEx Blue Cash Preferred Card?

The 6% cash back is applicable up to $6,000 per year on purchases at U.S. supermarkets and select U.S. streaming subscriptions. For supermarket purchases, anything above this cap will earn 1% cash back for the rest of the year. All other purchases generally earn 1% cash back.