Discover it is one of the market’s best cash-back credit cards. It offers great rewards with no annual fee and has some unique features. This guide will explain everything about the Discover sign up bonus, such as how to claim it, how it works, and much more.

Discover credit card sign up bonus

You will receive a $100 Discover signup bonus using the friend referral link. Typically, there is a $50 sign up bonus, but Discover offers double rewards during the first 12 months, so your $50 sign up bonus will become $100.

If you refer Discover to your friends and family, you will also get $100 per referral for the first 12 months. After 12 months, you will receive a $50 referral bonus.

Note: Rewards earned during those 12 months will be credited as a bonus within 2 billing periods after the cardholder’s first account anniversary.

How to Claim a Discover sign up bonus

If you’re a first-time Discover credit card user, you can get a $100 cashback bonus when you sign up discover and do your first shopping.

To claim your Discover sign up bonus:

- Visit [Discover link to website page] and click the blue “Get Started” button.

- Enter your email address, create a password, and enter the last four digits of your social security number to verify your identity.

- Select the amount of rewards you want to receive (1% on all purchases or 2% on select purchases) and click “Next.”

- Review the terms and conditions, then click “Apply Now.”

$100 Discover referral Bonus

There is a new referral bonus available with the Discover it Card. Referral links are the only way to access the offer. You can earn a $100 referral bonus, and the person signing up will receive a $100 signup bonus as well. Not everyone will see this improved offer in their accounts. The normal offer is just $50.

How to Claim a Discover referral Bonus

To earn a referral bonus:

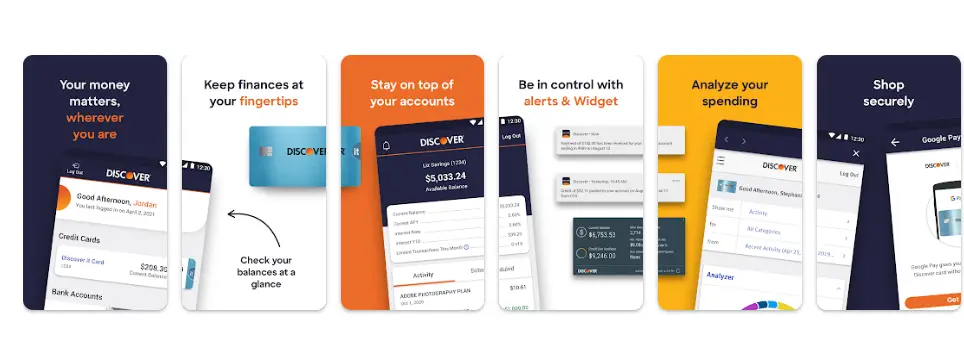

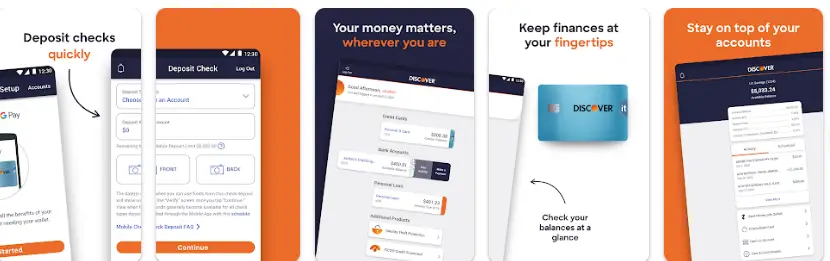

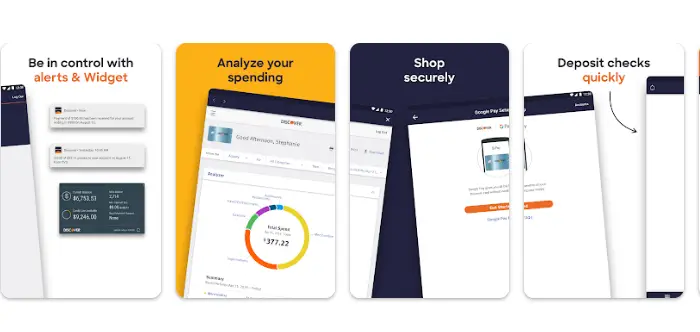

- The referrer must be a Discover Card customer and discover bank app download.

- The referee must be a new Discover Card customer.

- Both the referrer and referee must provide their phone numbers to be eligible for the referral bonus.

- If you are approved for your offer, it will appear on your credit card statement as “Discover Card Referral Bonus” or “New Customer Offer – Referral Bonus” or something similar in December 2020 (depending on when you apply). If you do not return non-received offers by April 30, 2022, you will not receive any paper mail from Discover about this offer.

You can earn up to $1,000 in free cash by referring friends and family to Chime’s banking services. If you refer friends and family to Chime’s banking services, you can earn up to $1,000. You can also earn bonus points if you use online reward apps. Read on for all the details.

More about discover ?

American financial services company Discover provides a wide range of products and services to individuals, businesses, and governments. Discover Financial Services (DFS) is a U.S.-based financial services company with $25 billion in assets under management as of 2019.

The brand was previously known as Discover Bank before it was rebranded as “Discover” when DFS merged with Synchrony Financial in 2017 to form what would become the fifth largest credit card issuer in the United States by total dollar volume sales accord ing to market research firm RFi Group (now known as eMarketer).

It also comes with many different options for earning extra rewards, including a referral program that lets you earn up to 30% cash back on all purchases made by your friends.

Discovering online savings can earn you $150 or $200

With Discover’s savings account, you’ll get a monthly APY of 2.00% compounded daily. A monthly maintenance fee of $0 is charged, and no fees are charged for insufficient funds, excessive withdrawals, or closing the account.

You can get your $150 or $200 bonus by opening a Discover Online Savings Account (online, by phone, or through the Discover App). Please enter the Offer Code Helpingdesi when applying. If you deposit at least $15,000 into your account, you will receive a $150 bonus, and if you deposit at least $25,000, you will receive a $200 Discover sign up bonus. The deposit must be posted to the account within 30 days of the date the account was opened. A maximum of $200 can be earned as a bonus.

- How does the offer work? Use the offer code to open a Discover Online Savings account. If you deposit at least $15,000 into your Discover account within 30 days, you will receive a $150 bonus. Get a $200 Discover bonus by depositing at least $25,000 within 30 days.

- How do you define a deposit? The promotion applies to virtually any transfer into your Discover online savings account, including check deposits made through Discover’s mobile app, online transfers from other Discover accounts, online transfers from external accounts, direct deposits from employers and government agencies, and checks mailed to Discover Bank with deposit slips.

- When do you receive your bonus? Once you have satisfied the bonus requirements, Discover will deposit the bonus into your account within 30 days.

- Does the offer have a time limit? Sept. 15, 2022, is the expiration date for this promotion. You can get it if you open a Discover savings account for the first time.

How do Discover card sign-up bonuses work?

Discover offers two programs that let consumers earn cash back on every purchase.

- When you open an account, you’re automatically enrolled in the plan.

- There’s no limit to the amount you can earn or redeem.

- Your first-year rewards are doubled if you spend enough money on your card to qualify for the bonuses.

- You’ll receive the match within 14 days of your anniversary date.

- In order to keep the bonus, you have to remain an active account holder.

- You can earn rewards and redeem them anytime, even if you are not a member when the points or miles were earned.

Discover card fetaures:

Discover offers many different types of cards to suit your needs and lifestyle, including:

- Cashback cards – Earn 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, gas stations and when you pay using PayPal, up to the quarterly maximum when you activate

- Student loans – These Discover student loans offer low rates and other special benefits such as deferment options, forbearance periods and more! (Eligibility required.)

Discover credit cards that offer sign-up bonuses

Discover credit cards have many benefits. All Discover cards come with no annual fee and no foreign transaction fee, and every card has a sign-up bonus that will match all the cash back or miles you’ve earned at the end of your first year.

- Cash Back Credit Card

- Student Cash Back Credit Card

- Secured Credit Card

- Student Chrome Credit Card

- Travel Credit Card

- Gas & Restaurants Credit Card

- NHL® Credit Card

How to earn more cashback from Discover card?

If you’re new to the Discover card, or to rewards programs in general, here’s how it works:

- Don’t miss out on the potential sign-up bonus.

- Aim to align spending with bonus categories.

- Activate bonus categories.

- Don’t overspend on bonus categories.

- Combine the Discover it® Cash Back with another card.

Discover Card holders earn cash back on every purchase they make. The amount varies based on what type of purchase you make (purchases made online or over the phone don’t earn cash back). For example, if you buy something at a grocery store with a $0 balance on your account, then you’ll get 1% cash back on that purchase. On the other hand, if your balance drops to $300 before making an in-store purchase at a gas station (which has an averageaverage price of $30), then that transaction will earn 3%.

Your account automatically calculates how much cash back is owed each day and add it to your account balance. You can also check this information by logging into discovercard.co /benefits and clicking on “Cashback Rewards.” Next to each category listed there (shopping & dining; gas stations; Amazon purchases; wholesale clubs) there will be a number representing how many cents were earned through purchases made within those categories during the past 24 hours.’

Conclusion

Discover is a great credit card to have in your wallet! If you’re looking for a card with no annual fee and attractive rewards programs, this might be the one for you.

FAQ

How To discover Monthly Fees

Discover has no annual fee, foreign tra saction fee and cash advance fee. In addition, there are no fees associated with balance transfers or late payments.

How much will I get for the referrals?

Referred friends who apply for the specific credit card you send via the link provided and are approved will receive a $50 Statement Credit reward. They will also receive a $50 credit if they make a purchase within three months of being approved. The Discover referral program is a bit unique in that it gives a credit to the person who gets approved for the card.

How many referrals can I do each year?

The maximum number of referral rewards ($500) you can receive per calendar year is 10. Since many other programs limit you to only five referrals per year, this is actually quite generous. I’ve also heard that Discover will double your referrals if it’s your first year with the Discover It.

There is a statement in the terms that states “Statement Credits you receive may be taxable to you.” A number of other issuers have started to issue tax forms for referrals that went out over the past year.

How can I apply for a credit card?

If you’re thinking about how to get a credit card, check your credit score to figure out your likely credit card eligibility. Then, a credit card comparison can help you choose the one that’s best for you. It’s always good to check if you’re pre-approved for a card before you apply