No, Sofi does not offer access to Zelle directly from Sofi Account. However, that doesn’t mean you can’t use Zelle to take money out from Sofi. One option is to link Zelle to a Sofi debit card. For this, you need to create a Zelle account and then add a Sofi debit card to your Zelle account.

Since Sofi has its own Peer-to-Peer (P2P) payment where individuals can transfer funds directly to other individuals from any bank to any bank, Zelle is not available directly in the SoFi app.

If you’re a fan of a higher APY saving account or a free sign-up bonus from a Bank, then you definitely know Sofi bank. Sofi Bank is still giving a $275 sign-up bonus by joining the Sofi bank and completing the qualifying criteria. Also Sofi offers a range of services for users. So join Sofi if it is not done yet. In this blog post, we’ll explore Does Sofi Have Zell and how customers can send and receive money from Sofi.

How do I connect Zelle to SoFi?

You can not connect Zelle to Sofi directly like Zelle to other banks, but you can create an account in Zelle, Download the Zelle app, and then connect your Sofi debit card.

You can follow the below steps to connect Zelle to SoFi.

- Create Zelle Account using email or Mobile number.

- Download the Zelle app.

- Log in to your Zelle account.

- Search for SoFi. But it will not show in the drop down. Don’t worry; and you will still be able to connect by following the next steps.

- Select “Don’t see your bank.”

- Enter your email for verification.

- Add your SoFi debit card information.

- Thats it. Now, you will be able to transfer money from Zelle to Sofi.

How to Transfer Money from Zelle to Sofi

Once you link Zelle with a Sofi debit card, then you can transfer money from Zelle to Sofi. Zelle always comes with any Bank account. You can follow below steps to

- Zelle is not available directly in the SoFi app, but you can link your SoFi debit card to your Zelle account.

- Once it is linked. then open a Zelle account from the App or browser

- Select your Zelle Bank account and the amount that you transfer.

- Select the reciever as Zelle and click on transfer.

- Thats it. Now you can transfer money from Zelle to Sofi account using Sofi debit card.

How to Transfer money from another bank account to Sofi and Vice Versa

Since transferring money from Zelle to Sofi is a bit complicated, you can use Direct P2P Transfer. For this, you need to Link an external bank account to SoFi Money through Plaid. Follow the below process:

- Log in to your SoFi Account or Sofi App.

- Click on the Banking Tab and then select Transfer the Money tab.

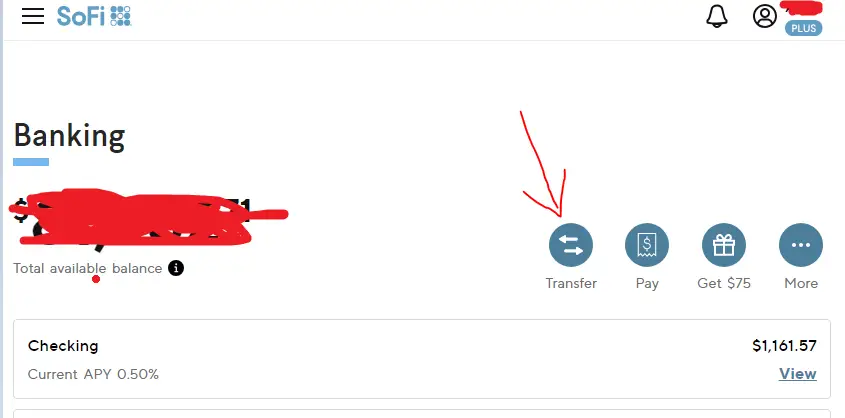

- Click the “Transfer” icon as shown in the image below

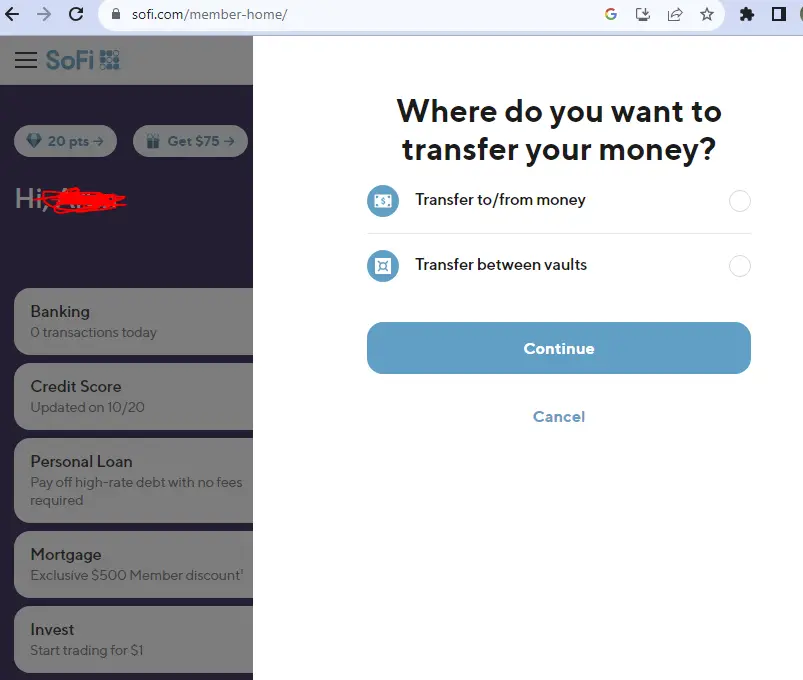

- Select ‘transfer money.’

- Connect a new account (external account) where you want to transfer money. Select or search for the institution you’d like to connect with.

- SoFi uses Plaid, a 3rd party servicer, to verify and connect external bank accounts. Enter your online banking credentials associated with your external account.

- If you are using Sofi app, then You may be prompted to leave SoFi’s App to do this. Don’t worry! You’ll be back soon.

- Now your account has been successfully connected, and you can fund (Transfer or receive) money between your SoFi Money account and to external bank account.

- Linking accounts is a one-time process. Once the account is linked, it will stay linked until you disconnect it. And you can transfer money with a few clicks.

Note: Remember, most of but Not all financial institutions can be located using Plaid.

Why Choose SOFi when it does not come direct with Zelle:

One of the most convenient features of online banking is the ability to send and receive money quickly and safely. If you’re using Sofi, you might be wondering how quickly you can send or receive money using Sofi P2P transfer powered by Plaid.

Also, Zelle comes with many challenges as you are limited to $3500 a day transfer with Zelle but Sofi P2P transfer does not have that limitation, so one way this is a good feature that Sofi uses Plaid

Still, if you like Zelle, then you can link Zelle to a Sofi debit card. You can transfer money from your Sofi account to a Zelle-enabled bank and use the payment app there instead.

Also, Sofi has many features, as below, and it is a great bank to have.

- $275 sign up Bonus for opening Sofi checking and saving account with Direct depost.

- Highest 4.5% APY on Saving account With Direct Deposits of at least $1,000 per month

- No account fees. and 55,000+ fee-free ATMs worldwide within the Allpoint Network

- Goal-based savings through Vaults.

- Mobile Check Deposit and Direct Deposit

- Free Financial career coaching.

- Easy P2P payments at no cost and Automated bill pay

- SoFi Money™ World Debit Mastercard (After funding your SoFi Money account with $1 or more). Freeze your SoFi Money Debit Mastercard on-the-go

- FDIC-insured deposits up to $1.5MM through the SoFi Money sweep program with partner banks. so no risk of your money.

Why Zelle allows Sofi debit card to link

So why use Zelle? There are many benefits to using this payment app instead of traditional methods like checks or wire transfers. One of the most notable is speed – Zelle transfers are almost instant, so you don’t have to wait around for days for your money to arrive. It’s also incredibly secure – Zelle uses encryption and other security measures to protect your financial information, so you can be sure that your money and personal details are safe. Plus, it’s free to use, which makes it a convenient and cost-effective option for many users.

Another reason to consider using Zelle is that it’s widely accepted across a range of banks and financial institutions. In fact, over 100 million people in the US have access to Zelle, making it one of the most popular payment apps around. This means that even if your friends or family members bank with a different institution than you do, they’re likely to have access to Zelle and can easily send and receive money from you. And because you can link multiple bank accounts to your Zelle profile, you can manage all your finances from one convenient location.

Of course, there are a few downsides to using Zelle as well. For one thing, not all banks offer the service, so it’s not yet available to everyone. And because it’s so convenient, there’s always a risk of overspending or impulse buying when using Zelle. It’s important to remember to budget carefully and only use the App when necessary to avoid running into financial difficulties.

Conclusion:

In conclusion, while Sofi doesn’t currently offer access to Zelle, you can download the standalone Zelle app and link your Sofi account to a Zelle-enabled bank. Or use Sofi P2P transfer, which is better than Zelle. From faster transfers to enhanced security and wider acceptance, Sofi P2P transfer is a great tool for anyone looking to manage their finances more efficiently. So why not give it a try and sign up today, even when you can earn a free $250 sign-up bonus by opening a Sofi account.