Time to Uncover! Is Klarna interest free magic? Dive in, grab a 2024 sign-up bonus, and enjoy ‘Buy now, pay later’ perks – Shop with confidence and smarter today.

Klarna has become a household name, offering a unique approach to payments and making the shopping experience smoother with Buy Now, Pay Later feature. Now, the big question on everyone’s mind: Is Klarna interest free in 2024?

But wait, there’s more! Hold on to your curiosity because we’re not just here to provide information. Picture this—an exclusive $30 sign-up bonus waiting for you! Yes, you heard it right. Klarna has something special in store for those ready to dive into the world of seamless transactions and enjoyable shopping.

You can click here to find more about Klarna.

So, if you’re ready to explore Klarna’s offerings, understand its interest-free claim, and unveil the surprise of an exclusive sign-up bonus, let’s move on this journey together. This article will answer all your questions. So stay with us and make your shopping experience a lot better with Klarna in 2024.

Is Klarna Interest Free BNPL App?

Is Klarna interest free, and does it deliver on its promise? Let’s break it down. When we say ‘interest-free,’ it means that there won’t be any additional fees or charges other than what’s mentioned on the price tag. This is great news for savvy shoppers!

Whether Klarna is interest-free or not depends on the specific terms and conditions of your transaction and the agreement you have with Klarna. Klarna frequently offers interest-free financing for a certain period or on specific purchases, allowing you to make payments without incurring any additional interest during that period.

In conclusion, Is Klarna interest free? It’s important to understand the details of your specific arrangement to ensure that you’re making an informed decision.

How Does Klarna Work?

Klarna Interest Free Payment Method

Klarna’s Interest Free Payment Method is a payment option that allows users to make purchases without having to pay any immediate or additional interest charges. This payment method offers flexibility and convenience to customers who want to spread the cost of their purchases over time.

- Klarna’s interest-free financing: Users can choose different payment plans depending on the terms and promotions available at the time of purchase.

- Paying in fixed installments: You pay over a specified period of time with this option.

- Buy Now, Pay Later: It enables users to buy what they need now and pay for it later.

It’s crucial to review the terms and conditions associated with each transaction before making a purchase. This helps ensure that users understand the repayment schedule, duration of interest-free periods, and any potential fees.

Pay in 4 Interest Free Payments: Best BNPL Plan

Klarna Pay in 4 is one of Klarna’s payment options that allows you to split your purchase into four equal payments. It’s a form of ‘Buy Now, Pay Later’ that provides flexibility in managing your payments. Here’s how it generally works:

- Split Payments: With Klarna Pay in 4, your total purchase amount is divided into four equal parts.

- Payment Schedule: You make the first payment at the time of purchase, and then subsequent payments are scheduled every two weeks.

- Interest-Free: Klarna Pay in 4 is often promoted as an interest-free option, meaning you won’t incur additional interest charges during the payment period.

Klarna Rewards Program

$30 Klarna Sign Up Bonus

Klarna, the ultimate shopping companion, welcomes you as a new member with a $30 sign-up bonus. With Klarna, you can shop with ease and earn rewards for your purchases.

Plus, you can enjoy the “Buy Now, Pay Later” (BNPL) Klarna interest free program. Signing up is easy – download the Klarna app, provide the necessary information to sign up, and receive the $30 sign-up bonus, which you can redeem as a gift card, deals, or discounts.

Klarna Referral Bonus

Klarna offers a referral program that incentivizes its users to bring in new users to their platform. Once you sign up for Klarna, you can easily access your referral link or code.

Share this referral link or code with your friends, and when they sign up using your referral link and make a purchase, you’ll receive a Klarna referral bonus, and your friend will also receive Klarna Interest free rewards.

The exact referral bonus may differ, and it could be either in the form of monetary benefits or points that can be redeemed through Klarna.

What is Klarna?

The Klarna App is an online shopping platform that simplifies the payment and shopping process. It has become one of the largest “Buy Now, Pay Later” services in the world, with over 60 million users and 250,000 retail partners.

If you’re thinking, is Klarna interest free, the answer is yes! In simple terms, Klarna offers you the convenience of shopping at your favorite stores and paying for your purchases later, without any extra fees, within an agreed-upon timeframe.

This helps you manage your spending by breaking down your payments into smaller, more manageable chunks.

Klarna offers these flexible payment options without any additional costs, so you can enjoy the benefits of shopping now and paying later without worrying about extra fees.

Is Klarna a Good Idea?

Is Klarna interest free a good idea? Well, it depends on your needs and how you handle your finances. Klarna can be a good idea with

- BNPL Feature: You want to buy something now but don’t have the full amount upfront. Klarna allows you to get what you need immediately.

- Flexible Payments: It offers flexibility in payments. Instead of paying everything at once, you can split the cost into smaller, more manageable chunks.

- Interest-Free Options: Klarna often provides interest-free periods, making it a cost-effective choice if you can pay within that timeframe.

However, it might not be the best idea if:

- Late Payments: If you miss payments, fees could apply, so it’s important to stay on top of your payment schedule.

- Overspending: It’s tempting to keep using Klarna, but it’s crucial to budget and avoid overspending.

Klarna and Other BNPL Apps

Klarna is a standout among other ‘Buy Now, Pay Later’ apps, particularly because it is interest free, unlike its competitors such as Afterpay, Affirm, and Splitit.

- Klarna offers payment flexibility to its users and is widely accepted by various stores without any additional charges.

- Afterpay is free to sign up but may charge late fees in case of missed payments.

- Affirm doesn’t charge any hidden fees but may have interest rates for certain purchases.

- Splitit is typically free but requires a credit card and pre-authorizes the total amount, which can affect credit limits.

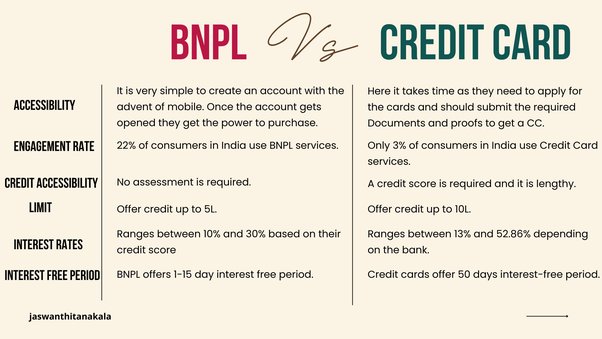

Credit Cards vs BNPL Apps

Let’s simplify the comparison between Credit Cards and Buy Now, Pay Later (BNPL) Apps

Credit Cards

- Buy Now, Pay Later: Credit cards like Amex, Chase, Discover, Wells Fargo, and Citi allow you to make purchases and pay for them later. You get a credit limit, and the amount spent adds to your balance.

- Interest Charges: If you don’t pay the full balance by the due date, you might be charged interest on the remaining amount.

- Flexibility: You can use a credit card for various purchases and have the flexibility to pay over time.

BNPL Apps

- Installment Payments: BNPL apps like Klarna or Afterpay let you split your purchase into smaller installments.

- No Interest (Often): Many BNPL apps offer interest-free payment plans, but late fees may apply if you miss a payment.

- Specific Retailers: BNPL is often associated with specific retailers or online platforms.

Which is Better for You?

- Credit Cards: Good for overall flexibility and building credit, but watch out for interest charges.

- BNPL Apps: Handy for specific purchases with the benefit of installment payments, but be mindful of late fees.

Choose based on your spending habits, preferences, and how you manage payments. The choice is yours, but it’s important to find out is Klarna interest free and identify what suits your financial style.

Conclusion

Before experiencing Klarna, I had the same question in my mind – is Klarna interest-free? After going through all the procedures and experiencing it myself, all my confusion cleared up.

By reading this article, you will be able to understand all aspects of Klarna and plan your payment method according to your preferences. If you find the article helpful, please comment and like it.

If you like to earn cashback and bonuses while shopping, check out other cashback apps like Rakuten, InboxDollars, Temu, Ibotta, Upromise, MyPoints, and Swagbucks.

FAQ

Is Klarna interest-free?

Yes, Klarna offers interest-free options. You can often enjoy a set period without additional interest charges, making your payments more manageable.

How does Klarna’s interest-free work?

Klarna’s interest-free option allows you to split your purchase into equal payments over a specific period, typically without incurring extra charges if paid within the agreed timeframe.

Are there any conditions for Klarna to be interest-free?

Yes, to benefit from Klarna’s interest-free offer, it’s crucial to adhere to the specified payment schedule and complete payments within the agreed-upon period. Late payments or other deviations may result in additional fees.