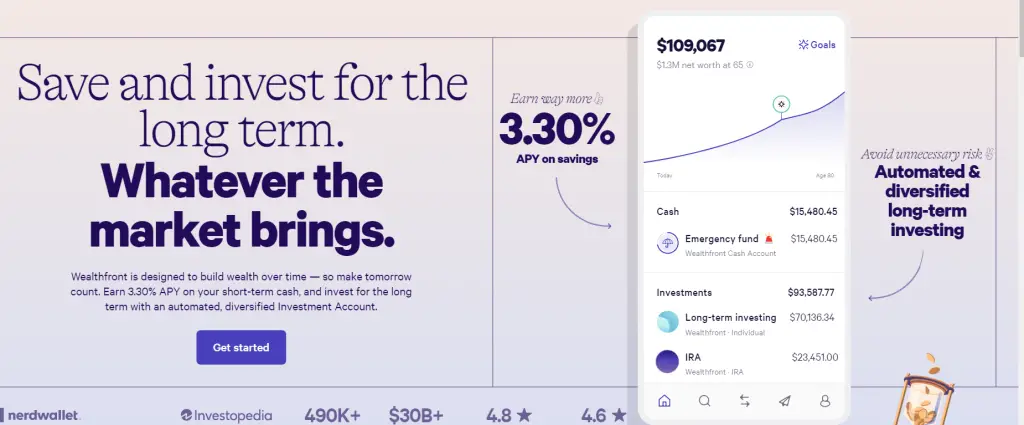

Wealthfront is one of the best Robo-advisors in the United States. It is a digital wealth management firm that provides automated portfolio management services to clients at a low fee.

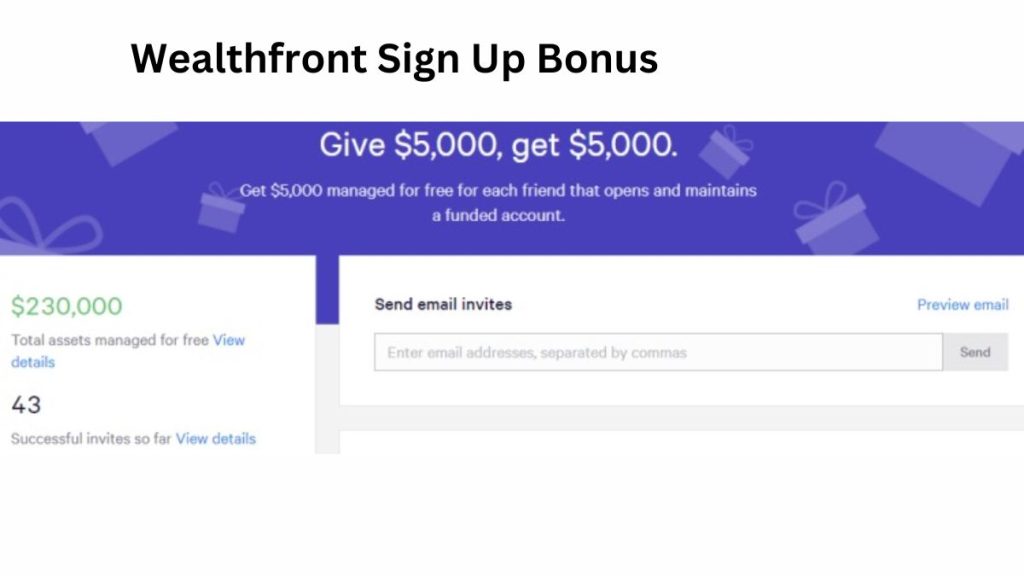

Wealthfront is giving you the chance to get $5,000 in sign-up bonuses and $5,000 referral bonuses. You only need to invest $500 to claim your Wealthfront Sign Up Bonus and get started with your retirement planning.

What is Wealthfront?

Wealthfront is an investment management company that offers automated, low-cost investment solutions to individual investors. Wealthfront is the robo-advisor for any level of investor seeking a comprehensive investment management solution for a low fee.

Andy Rachleff and Dan Carroll founded Wealthfront in 2009. Rachleff previously co-founded Benchmark Capital, a venture capital firm based in Menlo Park, California. Carroll was previously a principal at Hummer Winblad Venture Partners. As of September 2019, Wealthfront had $21 billion AUM across 400,000 accounts.

Wealthfront $5000 Sign-Up Promotion

You can get a free $5,000 sign-up bonus when you open an account with Wealthfront by clicking on the link below.

Chime offers a $20 sign-up bonus. For a limited time, Chime offers a $300 sign-up bonus too. The full details can be found on the Chime sign-up bonus page.

How to Claim a $5000 Wealthfront Sign Up Bonus

To participate, follow the steps below:

- Open the Wealthfront app on your phone or computer.

- Log in to your account.

- Enter your email address in the box below and click “Get Started”

- Once you’ve signed up, we’ll send you an email with a unique link to share with friends and family.

- If someone signs up using your link, you’ll receive a $5k sign up bonus.

Wealthfront $5000 Referral Promotion:

You and your friends will both receive $5,000 managed for free if you refer friends to Wealthfront. Wealthfront also manage $5,000 for free for your friend if they open an investment account with us.

How to claim a $5000 Referral Bonus?

To claim your $5000 referral bonus, follow these steps:

- Create a Wealthfront account

- Go to the Invite Friends page in your dashboard and fill out the form with your friend’s information

- Enter some brief details about why you think they’d be a great fit for Wealthfront

- Verify their email address by clicking the link we send them in the email we send you back after submitting their information.

Wealthfront PROS & CONS

Pros:

- Easy-to-use interface

- Low fees

- Automatic rebalancing of your portfolio to keep it balanced

- Has a Financial Planning tool that helps you understand how your investments will fit into your retirement

Cons:

- No fractional shares.

- No human financial advisors.

How to Earn Wealthfront Cash Back?

You can earn up to 3.30% APY on all your cash when you invest it with Wealthfront—no minimums, no fees, and no limits on how much you can hold there. Even better: There are no hidden fees or costs to use Cash Back.

Is Wealthfront It Legit?

Yes, Wealthfront is legit. Wealthfront is a robo-advisor that helps people invest their money. The company offers both taxable and non-taxable accounts, and there is no minimum deposit requirement. Read more about what it’s like to work with Wealthfront here to learn more about the low fees and great service.

Wealthfront Features

Your money is invested in low-cost investments with Wealthfront, a digital financial advisor.

Savings— Start for free, then after you accumulate $1,000, you’ll get $100 deposited into your account.

- No account fees

- Unlimited fee-free transfers

- Up to $2M FDIC insurance through partner banks

- Just $1 to get started

Investing— Invest your money in low-cost index funds, which will help you make more than two times as much as the S&P 500.

Taxes— Wealthfront automatically manages your tax burden to ensure you don’t overpay.

Conclusion

If you’re looking for a company that’s focused on your goals, and with a track record of helping clients reach them, then you should check out Wealthfront. Sign up today to get started