Are you interested in learning about Remitly vs Xoom for international money transfers? We’re here to help you make an informed decision.

Sending money in today’s digital world can often feel like a daunting task, but by choosing the right platform, you can make the process easy and hassle-free.

When choosing the best international money transfer platform, it’s important to consider factors such as reliability, fees, speed, and any potential advantages.

Remitly and Xoom are both reputable options in this field and have consistently satisfied their clients. However, deciding which platform is best for you will depend on your specific needs.

You can also consider other money transfer systems such as WorldRemit, Revolut, RiaMoney, and MoneyGram.

Let’s get started and explore the five key factors to consider in a Remitly vs Xoom comparison. We’ll provide you with all the information you need to make an informed decision. Click on the given link to find out more about Xoom.

Remitly vs Xoom: What are the 5 Things You Must Know?

You want international money transfer services, as they can offer a more direct Peer-to-Peer transaction without involving a bank like Venmo or Zelle.

However, there are several factors to consider when choosing between these services, such as their reach, processing time, and currency exchange options.

Because you are sending money to support your family, pay utility bills, fund personal travels, and other features.

Additionally, you are currently trying to decide between using Remitly vs Xoom. We can help you make a comparison between the two services and provide you with all the necessary details. Just follow me.

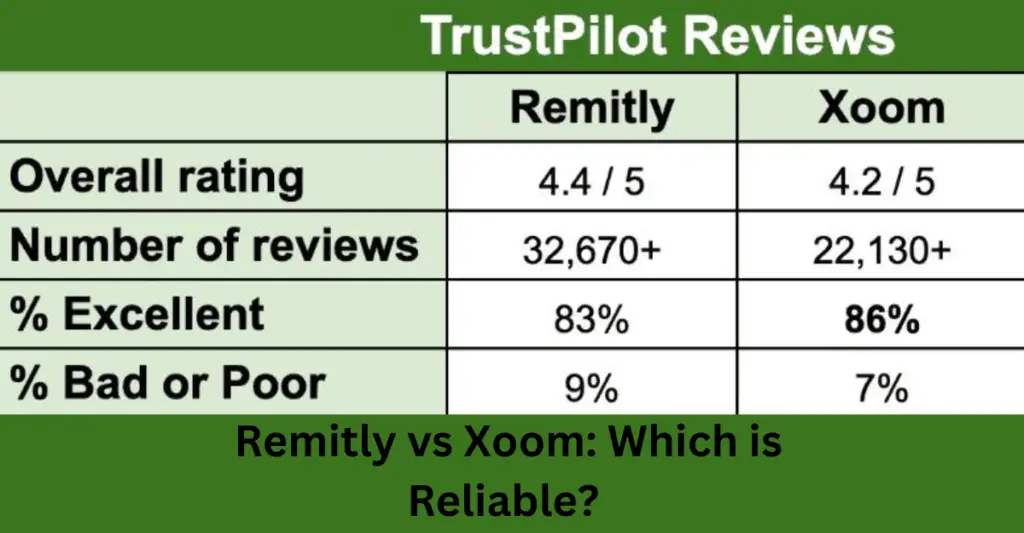

1) Remitly vs Xoom: Which is Reliable?

The most important factor in any transaction is trust and reliability. If you send money for your family’s expenses or online shopping, and it doesn’t work, then all promises become meaningless.

Trust is built on what you hear continuously in your surroundings. According to Trustpilot, Remitly has a 4.4/5 “Great” rating with over 42,000 reviews, while Xoom has a 4.2/5 “Good” rating with over 22,000 reviews.

Both Remitly and Xoom are excellent options for small personal transfers. Remitly has better transparency, while Xoom excels in coverage.

2) Remitly vs Xoom: Pros & Cons

Every international money transfer system has pros and cons, including Remitly and Xoom. Let’s compare their pros and cons.

3) Remitly vs Xoom: Which One is cheaper?

We are letting you know about the exchange rates and fees for international money services Remitly and Xoom.

The platform that provides the service will charge a fee for their service. In this case, we will compare Remitly and Xoom to find out which one is cheaper.

Remitly charges fixed service fees ($2.99-USD 3.99) for transfers below USD 1,000. On the other hand, Xoom fees depend on the transfer type (cash, bank, or bill payment), currency pair, amount, and how the transfer is funded.

Remitly sometimes charges a service fee, and Xoom always charges a service fee and currency exchange fee for all transfers.

In Remitly vs Xoom: Remitly’s exchange rate ranges from 0.5% to 3.5%, whereas Xoom’s exchange rate ranges from 0.4% to 3%, depending on the currency pair.

Bank-to-bank transfers are more affordable in Remitly, whereas they are expensive in Xoom.

4) Remitly vs Xoom: Which One is Ease of Use?

In this comparison of Remitly vs. Xoom, we will discuss the places where these services can be used.

Both Remitly and Xoom are online services, with Remitly available in 11 languages and Xoom in 15 languages, including English, Spanish, French, German, Japanese, and Russian.

Both services are similar in the aspects that they are mobile apps available for both iOS and Android platforms, and both provide multilingual 24×7 phone support.

Additionally, they offer similar payout methods, such as cash, bank transfer, and mobile wallet top-ups. Xoom also enables you to pay utility bills overseas (in select countries).

Check out other international money transfer services like TransferGo, TorFX, Paysend, Skrill, Xe, Wise, and Western Union.

5) Remitly vs Xoom: Which One is Faster?

Remitly provides two types of services for money transfers.

The Express service allows you to transfer money using a credit card, which gets delivered to the recipient within minutes.

On the other hand, the Economy Service utilizes bank transfers, and it takes anywhere between 3-5 business days for the recipient to receive the money.

When it comes to Xoom, the transfer speed depends on various factors such as currency, operating hours of agents and banks, Xoom’s audits, and the recipient’s bank. If you choose to fund your transfer through a credit/debit card, it will arrive within minutes or a few hours.

However, bank-to-bank transfers usually take 3-5 business days to get delivered to the recipient.

Conclusion

After reviewing the top 5 comparisons between Remitly vs Xoom, you can now decide which features you prefer or find most inspiring.

Consider factors such as fees, exchange rates, and speed.

You should also think about which features you are willing to compromise on, such as currency rates or the lack of billing services overseas.

Ultimately, the choice is yours.

Happy decision-making and sharing your choice!

FAQ

How does Remitly’s Express service differ from its Economy Service?

Remitly’s Express service, funded with a credit card, ensures rapid cash delivery to recipients within minutes. In contrast, the Economy Service, reliant on bank transfers, takes 3-5 days for the money to reach its destination.

What factors influence transfer speed on Xoom?

Transfer speed on Xoom depends on various factors such as currency pairs, operating hours of agents and banks, Xoom’s internal audit processes, and audits conducted by the recipient’s bank. Credit/debit card-funded transfers are typically received within minutes or a few hours, while bank-to-bank transfers may take 3-5 days.

Can I expedite transfers with Xoom for urgent transactions?

Yes, using credit or debit cards for funding allows for faster transfer times on Xoom, often resulting in immediate or near-immediate cash transfers. However, for bank-to-bank transactions, the typical duration is 3-5 days due to standard processing times between financial institutions.