Do you want to send money to friends and family online in a safe and fast manner? Join Zelle pay. Zelle is a digital payment company that lets you transfer money between accounts. Without carrying cash or writing checks, you can pay rent to a landlord, split dinner expenses with friends, or send your child money for lunch.

Zelle Current Promotion is offering a $10 Zelle sign-up bonus and $10 Zelle referral Bonus along with many benefits, so lets see what is Zelle and how you can claim $10 Zelle Bonus.

Zelle is a secure way to send money, split bills, and pay for things without having your bank account or credit card information compromised. Venmo and Instagram are similar applications that work with fewer banks

What is Zelle Pay?

With the help of the mobile payment app Zelle, you can send money quickly from one account to another, even if you and the recipient use different banks.

The process is quick and cost-free, whether you’re paying off an IOU, dividing the rent, or paying the babysitter. With the help of the payments network Zelle, you can quickly, simply, and securely transfer money from one bank account to another.

Transactions on the Zelle platform normally only take a few minutes, and there are no fees for sending or receiving money. In 2021, approximately 3,000 financial institutions joined the Zelle network, and its users sent $490 billion across 1.8 billion transactions.

Check out the best banking promotions from Go2bank $50 bonus, Ahead money sign up bonus, Best Banks with Immediate. $50 Sign-Up Bonus, $25 sign-up bonus

Zelle Sign-Up Bonus: Get $10

Once you sign up on Zelle through our special Zelle referral code, you will get a $10 Zelle sign up bonus when you make qualified payments through the Zelle app.

How to claim Zelle Sign up Bonus?

- Use the above button to download the Zelle App.

- Enter your email and name to register for Zelle Account

- Connect your US checking account or Mastercard or Visa debit card (the Zelle app will walk you through the process)

- Zelle will instantly verify your account.

Venmo VS Zelle Find out which is better money-saving app in 2023

Zelle Referral Bonus: Give $10 Get $10

Zelle referral program is offering a $10 Zelle referral bonus. When you invite someone through your unique Zelle referral code, create an account, and send qualified payment, you will get a $10 bonus.

To earn more money with referrals, you can try the best money transfer referral bonus apps.

How to Claim Zelle Referral Bonus?

- Log in to your Zelle account using the Zelle app.

- Select the Refer a friend option under the My Account tab.

- Share your Zelle referral link with your friends and family.

- When your friend signs up with your Zelle referral code/link and sends $20 or more, $10 will be credited to your account.

Zelle Referral Code 2023

Get a $10 welcome bonus when you sign up with Zelle referral code. To earn $10 referral bonus for each new user you refer, you can also share your Zelle referral link.

latest Zelle referral code to use

Zelle referral code 2023 –arunm159

Zelle $10 referral code – arunm159

Zelle Promo Code 2023 – arunm159

Zelle invitation code – arunm159

Zelle Referral Code November 2023 – arunm159

Is Zelle safe?

Yes, Zelle is completely safe! Several large banks formed Zelle, including Bank of America, BB&T, Capital One, JP Morgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

It’s understandable that Zelle has worked with over 100 banks and credit unions and is available to more than 95 million customers in the United States through its mobile banking applications, given the support of all these financial institutions.

How does Zelle Work?

With Zelle, you may send money to your loved ones quickly, safely, and easily via your preferred banking app or the Zelle app if your bank does not currently provide the service.

- Zelle transfers money directly from one bank account to another, unlike Venmo.

- With Zelle, customers may send money instantly using the recipient’s email address or phone number.

- In contrast, most banking transfers require account information and might take several business days to accomplish.

How to send Money with Zelle?

The P2P app Zelle may be used independently and functions very similarly to Venmo. In contrast to Venmo, utilizing Zelle from within your bank’s app requires both you and the recipient to be customers of one of 30 partner banks.

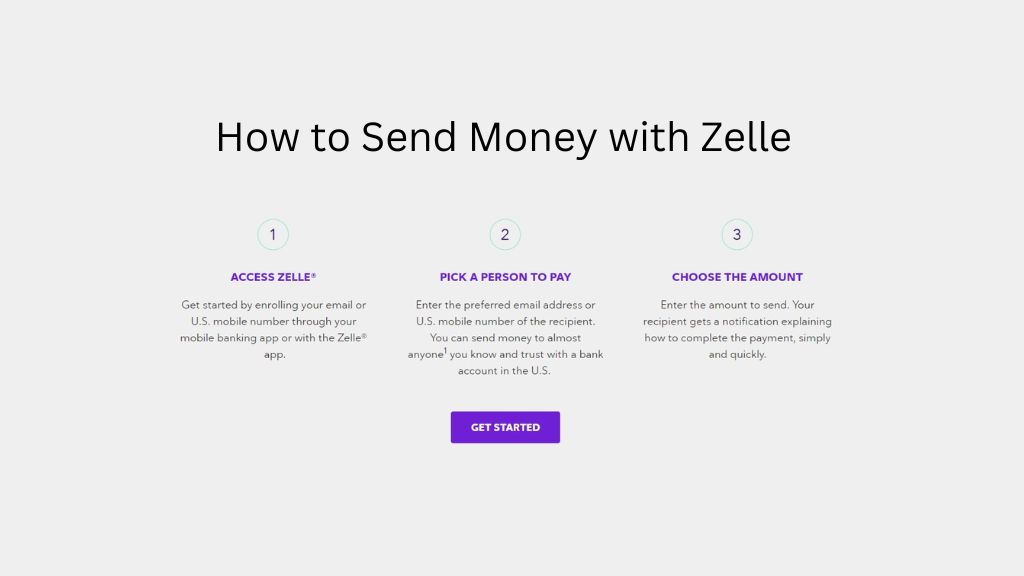

To send money with Zelle, just follow these three simple steps:

- Access Zelle. You can find Zelle in your mobile banking app. No additional download is required if your bank app is already on your phone. Download the Zelle app if your bank or credit union is not partnered with Zelle.

- Pick a recipient. You’ll need the recipient’s email address or mobile number to process the transaction.

- Enter the amount. The money will be deposited directly into your recipient’s bank account within minutes if they are already enrolled with Zelle.

How to Stop a Payment on Zelle?

If the recipient has not yet signed up for Zelle, there is only one option to cancel a Zelle payment.

The payment is made immediately into the recipient’s bank account and cannot be reversed if they are already a Zelle user.

- To see if a payment can be canceled, sign in to Zelle using the app or the website for your bank.

- Choose “Cancel this payment” after selecting the transaction you want to stop. Go to the account activity page after that.

Zelle Features:

Zelle offers some great features to make sending and receiving money easy.

- Compatibility: Almost all major banks are compatible with Zelle, and many even integrate the service into their mobile banking apps. For Zelle to accept and send funds, users must provide a phone number, email address, and debit card information.

- Free: With Zelle, you don’t have to pay fees, unlike with other P2P transfer services. When users send money with a credit card or want to immediately deposit funds into their bank account, Venmo and Cashapp charge fees. When transferring large sums, these fees can reach 3%.

- Unlimited Money Transactions: It is possible to accept any amount of money through Zelle. There is a possibility you can transfer more significant amounts if your bank offers Zelle.

- Reliability: Zelle can be considered a more secure way to move money than handling cash and sending bills or checks by mail. The company boasts that it protects your financial data, as your bank already does. Your money is always insured since your funds are never held by a third party.

- Fast money transfers: Instant money transfers are easy with this payment option. Zelle clients can receive money transfers within minutes in most cases. Thus, handling personal finances and money transfers has never been easier.

Conclusion:

Zelle allows you to send and receive money quickly and for free. Although there are restrictions on the amount you can send, the funds you transfer will arrive safely and quickly, which is a major advantage in P2P payments.

FAQs

What Banks Utilize Zelle?

The number of banks using Zelle keeps expanding. Nearly 10,000 banks and credit unions in the United States were a part of Zelle’s payment network, the company said in 2021.

Small local banks, online banks, and big national banks with locations all throughout the country are the many types of banks that offer Zelle to their customers.

Who Owns Zelle?

The firm behind Zelle is called Early Warning Services, LLC, and it is owned by seven of the biggest banks in the United States: Bank of America, Trust, Capital One, JPMorgan Chase, PNC Bank, and U.S. Bank, and Wells Fargo.

How do I get my first money from Zelle?

Sign up for the Zelle and get $10 sign up bonus as your frist money from Zelle app., follow these simple steps:

1.Click on the link provided in the payment notification.

2.Select your bank or credit union from the drop-down menu.

3.Follow the instructions provided on the page to enroll and receive your payment

Does Zelle offer a sign up bonus?

New Zelle users who sign up using referral links and spend $20 or more will receive a $10 reward.