The Capital One Quicksilver Cash Rewards Credit Card is a cashback credit card offered by Capital One. It is designed for consumers who want to earn cash back on their everyday purchases. The card offers a flat-rate cashback of 1.5% on all purchases, with no limit on the amount of cashback that can be earned.

Additionally, it has no annual fee and comes with a Quicksilver Sign Up Bonus of $200 for new cardholders after spending $500 in the first three months.

In this article, we will discuss complete steps on how to get Quicksilver Sign Up Bonus from these apps.

Quicksilver Cash Rewards Credit Card Sign Up Bonus

As a new cardholder, you can earn a $200 cash sign up bonus with the Capital One Quicksilver Cash Rewards Credit Card after spending $500 on purchases in the first three months from card opening.

If you’re a regular online spender then this credit card may be the best ideal for your shopping habits because it loads lots of saving and rewards with no-annual fees.

Rewards Rate

The Capital One Quicksilver Cash Rewards Credit Card earns 1.5% flat cashback on all purchases, with no limit on the amount of cashback that can be earned, as well as an elevated 5% cashback on hotels and rental cars booked through Capital One Travel.

The Capital One Quicksilver Cash Rewards Credit Card is perfect for everyday spending with its continued earning across the board.

Best Money transfer Sign Up Bonus apps:

- Xe Money Transfer Sign Up Bonus

- Xoom Sign Up Bonus

- Ria Money Transfer Sign Up Bonus

- Wise Sign Up Bonus

Annual Fees

The Capital One Quicksilver Cash Rewards Credit Card ideal choice for credit builders because it has no annual fees and doesn’t have many ongoing fees to keep track of. Also, there are no foreign transaction fees if you travel abroad.

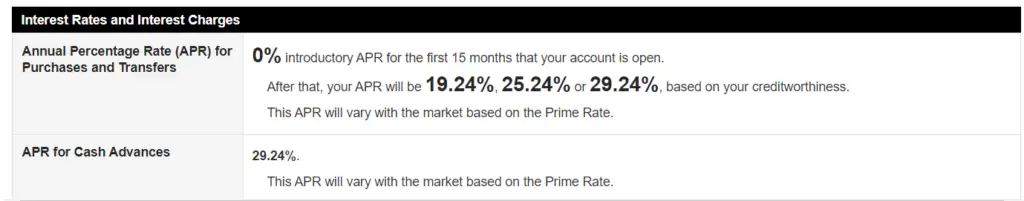

Intro APR

The Capital One Quicksilver Cash Rewards Credit Card offers 15 months of 0% interest introductory APR on purchases and balance transfers, then a 19.24% – 29.24% (ongoing for purchases) APR based on creditworthiness applies after this offer concludes.

When you use your Capital One card to make a large purchase, the interest rate jumps to the regular variable APR depending on your creditworthiness.

Credit Score

According to Capital One, the customer has an excellent credit score to qualify for Quicksilver Cash Rewards Credit Card. Typically, an excellent credit score means at least you have a 720 or more score.

People who are new to credit or have bad credit may want to look at options for cards with a more lenient recommended credit score.

Card Rewards for New Members Quicksilver Sign Up Bonus

Capital One is currently offering $200 bonus for new members who apply for Quicksilver Cash Rewards Credit Card and get and spend $500 on the purchase within 3 months.

How to Claim a Quicksilver Sign Up Bonus

- Open a Quicksilver account.

- Meet the minimum spending requirement within a specified time frame.

- Wait for the bonus to be credited to your account.

Note: The specific terms and conditions for the Quicksilver sign up bonus, including the minimum spending requirement and time frame, may vary. It is best to check the details of the offer before signing up.

Uber One Membership Free

If you’re a foodie and ordering food online regularly, Quicksilver Card would be the best option for you. You can get up to 6 months of complimentary Uber One membership statement credits through November 14, 2024. Plus, you also get 10 cashback on purchases with Uber and Uber Eats.

Uber One Membership Benefits:

- Unlimited $0 Delivery Fee on eligible food, groceries and more on Uber Eats

- Up to 10% off eligible orders with Uber Eats

- Up to 5% off eligible rides with Uber

- Member-only perks and promotions

Explore Capital One credit card benefits

Here are some of the best features of the Capital One Quicksilver Cash Rewards Credit Card. As a cardholder, you’ll have access to a number of other promising card benefits.

Capital One credit card benefits may vary based on the card type, but some common benefits include:

- Cashback or rewards program

- No annual fee

- Sign-up bonus

- Travel benefits such as lounge access, baggage insurance and travel accident insurance

- Zero liability protection for fraudulent purchases

- Flexible payment options

- Extended warranty protection

- Fraud monitoring

- Personalized customer service

- Access to credit education resources.

Conclusion

The Capital One Quicksilver Credit Card is best for people who prioritize simplicity in their financial lives. New cardholders can earn $200 bonus by spending $500 in first 3 months. No annual fee, earning rewards with every purchase, and no foreign transaction fees make it a top pick for international travel.

FAQ

Will the status of my application affect my friend?

If you are approved, your friend might receive a referral bonus if your application is approved. Your friend will not be notified of the status of your application unless they apply or are approved.