The new Chase Sapphire Preferred sign up bonus can be used for cash back, gift cards, flights, hotels, and more.

When you post stories on your social media account, people often wonder how you are able to travel so frequently. They might not be aware of the magic secret of the Chase Sapphire Preferred sign up bonus.

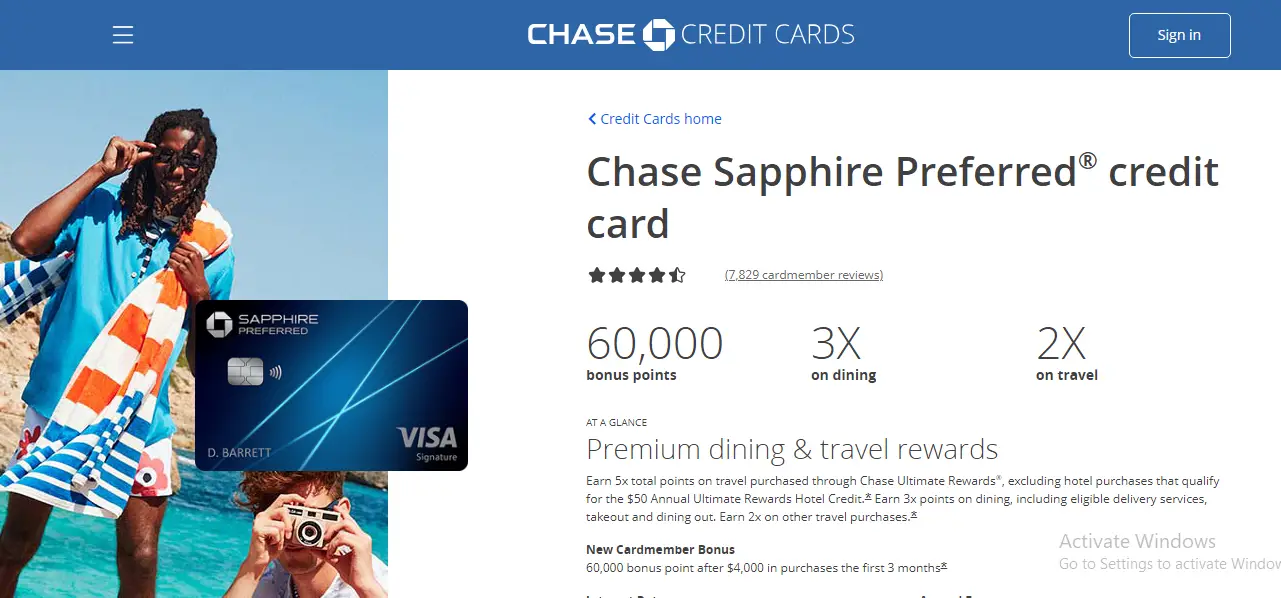

As a new member, Chase Sapphire is offering you 60,000 points, which are equivalent to $750, after you make $4,000 in purchases within the first three months.

You can also earn 3X points on dining and 2X points on travel, which equals a total of 5X points on travel. Click on the link below to get the magic.

The steps to get a $750 Chase Sapphire Preferred sign up bonus are simple.

- Visit the Chase website using the link provided.

- Provide all the necessary credentials.

- Once you are approved, activate your Chase Sapphire Preferred card.

- Spend the required amount within the specified timeframe.

- After you meet the spending criteria, you can enjoy the $750 bonus and 5X travel reward.

The Chase Sapphire Preferred sign up bonus comes with many other perks, including a $0 intro APR, $0 foreign transaction fee, as well as low balance transfer and annual fees with good credit scores.

All of these features make Chase Sapphire the perfect travel partner for you. So, without wasting any more time, let’s get into the article and learn more about the Chase Sapphire sign up bonus, how to get it, and more about Chase.

Chase Sapphire Preferred Sign Up Bonus

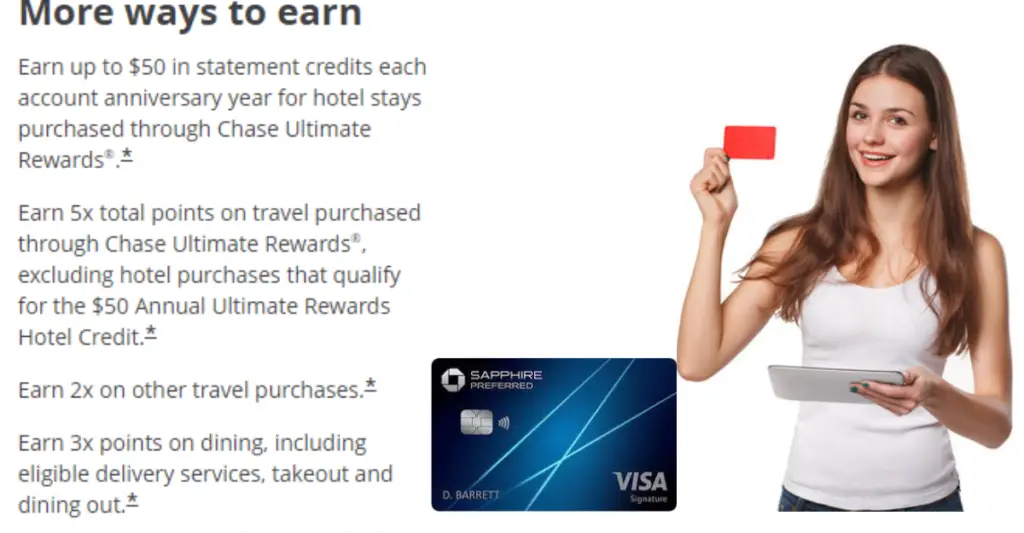

More Ways to Earn

Chase is a leading player in the financial industry, offering a range of rewards and perks to its customers. The Chase Sapphire preferred sign up bonus of $750 and 5X rewards on travel are just the beginning. By signing up for an account, you can earn up to:

- $50 in statement credits each account anniversary year for hotel stays purchased through Chase Ultimate Rewards.

- 5x total points on travel purchased through Chase Ultimate Rewards (excluding hotel purchases that qualify for the $50 Annual Ultimate Rewards Hotel Credit) and 2x points on other travel purchases. 3x points on dining (including eligible delivery services, takeout, and dining out),

- 3x points on online grocery purchases (excluding Target, Walmart, and wholesale clubs),

- 3x points on select streaming services.

- Plus, earn 1 point per dollar spent on all other purchases.

How to Claim Sign Up Bonus

To earn a $750 Chase Sapphire Preferred Sign Up Bonus, as well as $50 statement credits each year, follow these simple steps.

Start by submitting your credit card application and making sure you meet the eligibility requirements. Then, carefully review all the terms and conditions of the card, paying close attention to the sign up bonus details, spending requirements, and any deadlines.

Once your application is approved, start taking advantage of all the benefits, including 5x points on travel, 3x points on groceries and select streaming services, and 1 point per dollar on all other purchases.

$200 Additional Perks Along with Sign Up Bonus ( limited time offer)

DoorDash DashPass Subscription: Enjoy a complimentary DashPass membership for DoorDash and Caviar, valued at $96/year. Activate by Dec 31, 2024, for $0 delivery fees and reduced service fees on eligible orders for a minimum of one year.

Instacart Membership: Receive 6 months of free Instacart+ membership, valued at $60. Skip the trip and have groceries delivered. Activate by July 31, 2024; membership auto-renews.

Quarterly Instacart Credit: Sapphire Preferred Instacart+ members earn up to $15 in statement credits each quarter through July 2024.

5x on Peloton Purchases: Earn 5x points on Peloton equipment and accessories over $150 through March 31, 2025, translating to $75 cash redemption.

5x on Lyft: Gain 5x points on Lyft rides through March 31, 2025, including the existing 2x points on travel.

Complimentary 4th night at Ennismore Hotel properties: Access VIP benefits at SLS, Mondrian, Delano, House of Originals, and Hyde hotels worldwide. Enjoy a complimentary 4th night, room upgrades, late checkouts, daily complimentary breakfast, and a $30 food and beverage credit.

Give Additional Value To Your Sign Up Bonus

25% More Value for Travel:

- Redeem points for travel through Chase Ultimate Rewards and get 25% extra value.

- For instance, 60,000 points become $750 toward travel.

No Expiry for Points:

- Ultimate Rewards points don’t expire as long as your account is open.

Annual Bonus Points:

- On each account anniversary, receive bonus points equal to 10% of the total purchases made in the previous year.

- Example: Spend $25,000 on purchases and get 2,500 bonus points.

Am I Eligible for Chase Sapphire Preferred Sign Up Bonus

Eligibility Factors for Chase Sapphire Preferred:

- A FICO score of at least 700 is recommended.

- Credit history, income, and other factors are considered.

Sign Up Bonus Eligibility:

- You can qualify for a welcome bonus once every 48 months for any Sapphire card.

- Not eligible if currently holding a Sapphire card.

- No qualification if you received a Sapphire card intro bonus in the past 48 months.

Chase 5/24 Rule:

- Chase will approve a new card only if you’ve been approved for less than five credit cards in the past 24 months.

- Business cards usually don’t count towards this limit.

- Exception: Business cards typically don’t affect your 5/24 count, as they may not appear on your credit report.

BNPL With My Chase Plan

Splitting Purchases with My Chase Plan:

- If you’re eligible, you can divide card purchases of $100 or more into smaller monthly payments.

- There’s no interest; instead, you pay a set monthly fee.

Referral Program to Make Money

Did you miss out on the referral bonus offered by Chase? Don’t worry; you can still refer your friends and family to sign up for the Chase Sapphire and enjoy its benefits.

I am confident that they won’t refuse to sign up using your referral link, and both of you will receive rewards.

By referring your friends, you can earn up to 75,000 bonus points per year for the Chase Sapphire Preferred or the Chase Sapphire Reserve credit card. You can receive 15,000 bonus points for each approved referral.

Click on the button below to start referring now.

Alternative To Chase Sapphire Preferred Card

Several credit cards are considered alternatives to the Chase Sapphire Preferred Card, offering various perks and benefits. One notable alternative is the Capital One Venture Rewards Credit Card. Other alternatives such as AmEx, Citi Premier, Wells Fargo, Discover it, Chase Freedom Unlimited and Bank of America are outlined below.

Capital One Venture Rewards Credit Card:

- Rewards: Earn 5X miles per dollar on hotel and rental cars through Capital One Travel and earn 2X miles per dollar on all other purchases.

- Annual Fee: $95 annual fee.

American Express Gold Card:

- Rewards: Earns points on dining, groceries, and flights.

- Annual Fee: $250 (terms apply).

Citi Premier® Card:

- Rewards: Earns points on travel, dining, and entertainment.

- Annual Fee: $95.

Wells Fargo Propel American Express Card:

- Rewards: Earns points on dining, travel, and streaming services.

- Annual Fee: No annual fee.

Discover it® Miles:

- Rewards: Earn miles on all purchases.

- Annual Fee: No annual fee.

Bank of America Travel Rewards Credit Card:

- Rewards: Earns points on all purchases and additional rewards for Bank of America customers.

- Annual Fee: No annual fee.

Chase Freedom Unlimited:

- Rewards: Chase’s Cashback Match feature doubles your cash back at the end of the first year, effectively making it 3% on all purchases for that initial year.

- Annual Fee: No annual fee.

When choosing an alternative, consider your spending habits, travel preferences, and the specific rewards or benefits that align with your needs. Each card has its own features, and the best choice depends on your individual preferences and financial goals.

Conclusion

The information I have provided above has cleared all your doubts, and now you should have a good understanding of Chase Sapphire Preferred and how it stands out for its simplicity and generous cashback rewards.

With Chase Sapphire Preferred sign up bonus and straightforward earning structure, it is an excellent choice for those seeking consistent rewards without the hassle of tracking categories or dealing with complex offers.

Additionally, the travel perks it offers add to its appeal, making it a solid option for everyday spending.

If you found the content informative, please leave a comment and consider subscribing to it.

Additionally, if you occasionally send money, it may be worth checking out the benefits of using money transfer services such as Remitly, WorldRemit, PayPal, Wise, Xoom, Xe, Paysend, MoneyGram, TorFX, RiaMoney, and Revolut.

FAQ

What is the annual fee for the Chase Sapphire Preferred Card?

The Chase Sapphire Preferred Card has an annual fee of $95.

Can I redeem Chase Sapphire Preferred points for cash back?

While you can redeem points for cash back, the Chase Sapphire Preferred’s strength lies in travel rewards. You can get 25% more value when redeeming points for travel through Chase Ultimate Rewards.

Are there foreign transaction fees with the Chase Sapphire Preferred Card?

No, the Chase Sapphire Preferred Card does not charge foreign transaction fees, making it a great choice for international travelers. You can use your card abroad without incurring additional fees for currency conversion.